Setting your consultation fees is the best and worst part of running a consulting business. It’s the best because you get to decide your worth (not management or HR)—and it’s the worst because you likely hate talking money with your clients.

We get it. It’s not easy.

Yet, setting your consulting rates doesn’t need to be an anxiety-inducing experience that keeps you up at night. Done right, it should be a downright rewarding experience for both you and the client. Let’s show you how it’s done.

Table of Contents

Calculating Your Consulting Rates

How to Calculate Average Hourly Rates

How to Calculate Per-Project Rates

Communicating Your Consulting Rates

5 Must-Know Tips on Pricing

Whether you’re brand-new to consulting or looking at signing a new client, you’re probably wondering, “How much should I charge for my services?”

Well, it depends.

Pricing is relative. If you came looking for a golden number for us to tell you, we’re sorry to disappoint, but price is just a perception of value—not a hard and fast number.

While we’ll get into average consultant salaries and consulting rates by industry later, these are just averages. They can influence your decision-making, but your ultimate price point is entirely up to you.

Don’t worry—we won’t leave you hanging at that. Let’s look at a few tips to help you dial in your price.

1. Estimate Your Value

Estimating your value isn’t quite the same as playing the game The Price Is Right. Your value isn’t just an end product like an article, podcast episode, research insights, or 1:1 training—it’s much more than that.

Your value is long-term financial gain, removing annoying roadblocks, revealing business-changing insights, creating ongoing traffic, and more. It’s not just the time you put into consulting—it’s the results of the consulting.

Imagine the US Declaration of Independence, for example. It’s only a 1,458-word document, which is almost half the length of this article. Yet, as much as we love this piece, we’d argue the Declaration of Independence is worth approximately 2.5 billion times more. The end value is different from the input—and your consulting fees should reflect that.

Think of why your client may be hiring you. It could be for several reasons, but most likely it’s because:

- You have the expertise or a skillset that your clients need.

- It’s more cost-efficient for you to do the work.

- Your client doesn’t have the time to do it.

All these reasons have value beyond the actual work to complete, and they should be factored into your price. Here are a few additional factors to consider when estimating your value:

- Size of client

- Expertise

- Bandwidth

- Time constraints

- Resources available

- Availability of substitute consultants

Have a Salary In Mind

You’re most likely transitioning to a consultant career from a previous job, business, or corporation. How much you made there might contribute to going off on your own, but it can help provide a baseline of what you need to hit. Ask these questions to ensure your aspirational salary can pay your bills and be realistic.

- What salary do I need to support my lifestyle?

- What salary would support my ideal lifestyle?

- What is the value of the perks from my previous job that I need to include in my salary (healthcare, insurance, company car)?

Don’t Skip: How to Get B2B Leads for Your Online Business

2. Predict the Amount of Work

The scope of work should be a large determinant of your rates, but pricing per hour or project is challenging to estimate. For example, it may be quicker for you to write a 2,000-word article for a company than to help produce a 5-minute podcast episode.

It’s all relative. Don’t get stuck doing massive amounts of work for less than you’re worth—it’ll impact your work, happiness, and your client’s future expectations.

Before you set a price, ensure you understand everything that the project entails. If you’re offering a 1-hour consulting session, consider the amount of prep work necessary and if your client will be able to send any post-consultation follow-up questions. These might seem like small additions, but they can start to add up quickly.

For example, if a client offers you a massive sum for a big project, you may dissect the work and find it’s taking you twice as much time and effort to make what a smaller project with a smaller budget rewards you.

Once you have a better grasp of the amount of work required, you’ll be better able to set your rates.

3. Establish Your Client’s Perceptions

You get what you pay for. A free steak at a friend’s house is never going to taste quite as good as the $60 steak you bought at an acclaimed restaurant—and that has nothing to do with the actual food or cooking.

If you set your rates too low, then clients may perceive the work as amateur or low-quality—before they even see it!

Because your fee is an expression of value, low consulting rates don’t necessarily lead to work or respect. If your clients have regularly hired consultants or freelancers, they’ll be familiar with average consulting market rates. Pitching yourself on the low end simply to undercut competitors won’t always serve you well.

However, if you set your rates too high, you may alienate yourself from the client and out price yourself out of the project. Clients may perceive you as the high-end of the consulting or freelance market, and they may decide to settle for a less experienced but more affordable alternative.

When you’re starting out, finding the right rate is tricky. If you don’t have much experience, find an initial client and offer to do work for a discounted price or free. Focus on delivering the best results possible, which means don’t try and get additional clients. Once you’ve shown the results, create a case study from that first client. Repeat this step and start scaling your rates up from there until you find a comfortable cost for your clients.

Finding the Goldilocks-approved consultation rate is easier said than done, but know it exists somewhere in the middle ground.

4. Manage Your Cash Flow

Set rates that make sense for your business and personal expenses. This tip goes beyond value, the scope of work, and client perceptions—you have to set prices that’ll lead to adequate quality of life and profitability for your business.

Look at your expenses. What rate do you need to set to cover your costs, make a profit, and live the life you want to live? This answer varies for everyone, so you’re not going to find a golden number anywhere.

While you’re at it, start looking at your future. What are your goals for your business and yourself? Don’t discount your ambitions as a consultant and business owner. You have a right to live comfortably and thrive financially, too.

5. Find Baseline Expectations

This is a tricky tip. Proceed with caution. Many consultants and freelancers make the mistake of confusing average consultant rates with standard pricing—that’s not the case. Averages don’t take into account your value, the scope of work, client perceptions, or even your cash flow.

Feel free to look at consulting rates by industry, but don’t use them as your bible to pricing—use them as another data point to reference.

However, remember that your client is likely going to be looking for these same numbers. They’ll want to know how much they should be charging a consultant, so they don’t get duped. If your rates vary from industry benchmarks, be prepared to back it up.

How to Calculate Your Consulting Fees Based on Different Payment Methods

Your pricing methods won’t always be the same. Some clients will prefer to pay consultants per hour, while others may want to pay per project or retainer. Rather than putting your foot down on one single method, it’s best to flexibly price yourself so that you’re earning what you’re worth—regardless of the systems and processes.

The tips above paired with the processes below should help you settle on what to charge for your consulting services and formulate a consulting business price guide.

Note that your pricing structure should be under consistent review, especially as you grow your skills and attempt to expand your consultancy. Your rates should change (preferably upwards) every year as you gain experience, build your portfolio, and prove your worth. Return to these steps as you scale your business.

How to Calculate Average Hourly Rates for Consulting Services

We don’t necessarily recommend charging by the hour, but you may want to structure your pricing this way if your consulting work involves meetings and a lot of in-person work. Determining an hourly rate is also an important part of calculating per-project or retainer rates, allowing you a baseline to work from. So whether you want to use the 3 x hourly method for like-for-like rates or the more complicated 52 week, your starting rate is critical to the long-term viability of your consultancy.

3 x Hourly Method

A quick and simple way to calculate your consulting rates is the 3 x hourly method. This method is best if you’re transitioning from a similar agency role or consulting as a side hustle. Using 3 x hourly, you can accurately match your current or previous rate without undercutting or overcharging your clients.

To calculate your rate using the 3 x hourly method follow these steps:

- Take your current hourly rate

- Multiply it by 3

Example: $30 per hour x 3 = $90 per hour consultancy rate.

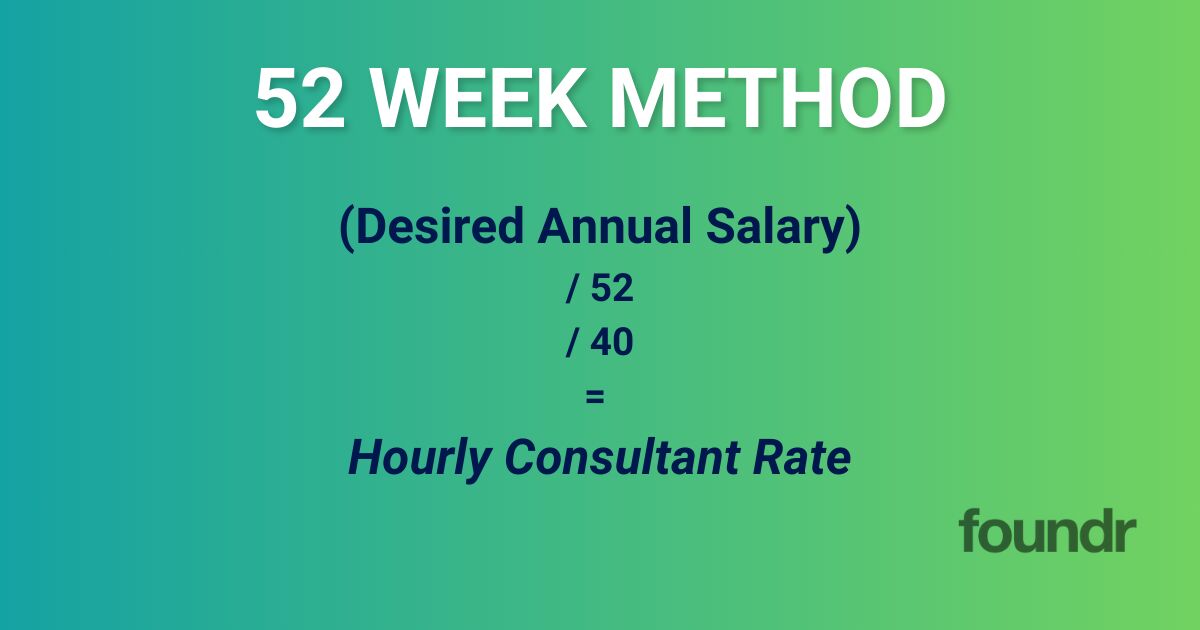

52-Week Method

The 52-week method is a bit more complicated. This should be used if you’re looking to make a full transition from a corporate job to running a full-time consultancy. To calculate your hourly consulting rate from your working week salary follow these steps:

- Determine what salary you’d like to make.

- Take that number and divide it by 52 (number of working weeks), then again by 40 (number of hours each week).

- Take that number and mark it up by 25% to 50%.

For example, let’s say you wanted to make a gross salary of $60,000 per year. To calculate your hourly rate, you’d divide $60,000 by 52 (which is roughly $1,154), then divide that by 40 (which is $28.85). Then, mark that up 40%, which results in an hourly rate of about $40.

That 40% markup would cover the cost of your expertise and business expenses like overhead, benefits, taxes, and more. These costs are different for everyone, depending on tax status and type of business.

When making your calculations, feel free to play with the numbers to satisfy the lifestyle you want. As a consultant, you’re not getting paid for vacation or maternity leave, so you’ll need to factor this time into your rates.

For example, you may want to divide your gross salary goal by 49 (instead of 52) to compensate yourself for 3 weeks of “paid time off.” Or you may want to work just 4 days a week instead of 5—in that case, you might divide your weekly rate by 32 hours instead of 40.

That’s the beauty of consulting and freelancing—you get to play with the numbers to make them work for you.

How to Calculate Per-Project Consultant Rates

Charging by the project is more aligned with the value-based pricing model we’ve been discussing. Fixed fees create a more straightforward workflow (as you don’t have to be worried about tracking hours), but this structure can be tricky due to scope creep and the natural tendency to underestimate how long a job will take.

Defining and reinforcing a predetermined scope of work is crucial when charging by the project. The best way to determine your per-project rate is to figure out how many hours you estimate the job will take. You can make an educated guess based on your knowledge of the subject and how long it’s taken you to complete certain tasks in the past.

This step can be tricky for new consultants, so this is where industry averages come in handy.

For example, let’s say you were hired to write a feature article for a magazine. The first thing to do is figure out how many hours the project will take:

- Research: 1 hour

- Review of interview transcript: 2 hours

- First draft: 5 hours

- Two rounds of edits: 2 hours

In total, the project will take about 10 hours. Multiply that by your hourly rate and then add a 10-20% markup for unexpected contingencies, and voila—you have a rough estimate for a per-project consultant rate.

However, remember that this kind of pricing still excludes the true value of your work. Think back to the Declaration of Independence example. If you’re performing business-altering work, that has a financial price tag to it, as well.

How to Charge Consulting Retainer Fees

Working “on retainer” means you receive a monthly fee for working a certain number of hours or performing routine tasks. Retainer fees can be wonderful for your consulting business as it’s income that you can rely on and plan for (a rare commodity in the freelancing world).

It’s hard to charge a retainer fee from the get-go since you’ll only have an estimate of the scope of work. It’s best to switch from a per-project or per-hour basis to a retainer fee once you have nailed down expectations for both you and the client. Plus, some clients aren’t sure what exactly they need, and you don’t want to get locked into a rate that doesn’t cover the entire scope.

Calculate your consulting retainer fee the same way you’d do your project rates—it’s essentially a comprehensive monthly project rather than smaller one-off assignments. Some consultants offer discounts for retainer fees as they’d prefer consistent income over hourly or per-project invoices. The choice is up to you.

Communicating Your Consulting Rates Without Crumbling

Knowing how much to charge for your consulting fees is just half the battle. Now, it’s time to learn how to communicate your prices with clarity and confidence.

The conversation about rates happens with every client, sometimes more than once. Sometimes it’s pleasant, sometimes it’s awkward, and sometimes it’s ugly. Here are a few tips to make it as smooth as possible.

Remember That Every Client Is Different

Some clients will start the conversation by proposing their standard rates, while others will ask what you charge. And some might not even know where to begin.

Every client is different. They have different needs, processes, and expectations. Be patient, and don’t expect them to know exactly what they want from the get-go.

Do your research and prepare yourself with the rates we outlined above, and you’ll be ready and adaptable going into any conversation.

Don’t Talk Numbers Until You Understand the Scope

Understanding what the client needs (and how well they understand it themselves) play a major role in how you price or whether you want to move forward at all. Toss out a number too early, and it might be hard to change it later if the project evolves.

If a client asks, “How much do you charge for consulting?” right out the gate, try to guide the conversation towards the project details. For example, you can say, “I’d like to get a good idea of the scope of work before discussing rates.”

Be Confident, But Be Willing to Compromise

Confidence goes a long way. Your client wants a consultant they can trust, and that trust is established throughout negotiations and working together.

When asked, don’t present your rates as a question. State your prices and be prepared to stand your ground. If the client accepts your rate, congratulations! However, that doesn’t always happen.

Sometimes, you’ll need to compromise. For example, a client’s budget might not be able to afford you. Instead of altogether rejecting the client (or the client rejecting you), steer the client towards negotiation.

You may convince your client to cut out some of the scope to meet your pricing constraints, or you may insert a clause into the agreement to raise your rates after 2 to 3 months of satisfactory work.

Reminder: Revenue Is Vanity

It’s invigorating when your client pays your invoice, and those dollar figures spring up in your bank account. But remember, revenue builds momentum, but profitability keeps your business alive.

That’s why if you’re starting as a consultant, attempt to build your business as lean as possible. That means no wild spending on conferences or CRMs. The leaner you run, the more profits you’ll make.

And with those profits, you can reinvest into your consulting business by making a rainy day fund, ideally three months of operating expenses. Then, you can hire extra help or upgrade your laptop. We suggest your first hire be a part-time bookkeeper to ensure your business runs smoothly in the black.

So, remember that how much you charge for consulting trickles down to what makes your business run and remain profitable and secure.

Consulting Fees FAQs

What do you charge for consulting when starting out?

Find a client and offer to do work pro bono. Don't get distracted by adding new clients or branding your business—just do your best possible work. Then, create a case study on your results. Rinse and repeat, slowly raising your prices with each new client.

What type of consultants makes the highest fees?

The consultants who charge the highest fees are lawyers, finance, and tax professionals. Why? Because they have unique and specific expertise that is rare. So, you might not be a copyright lawyer or investment consultant, but think about where your expertise is rare in your field. By differentiating your skillset and developing a niche, you'll become more valuable as a consultant.

Should I charge consulting fees under an LLC?

We suggest talking to a tax professional before going into the consulting world. If you're consulting as a side hustle to help some friends with their marketing, it might be OK just to claim the income as an independent contractor. But the more you consult, especially B2B, the greater your risk of being liable for legal action. Forming an LLC for your consulting business will protect your personal assets.

Keep Learning: Statement of Work Templates and Examples for Consultants

Believe in Your Value and the Right Price Will Follow

It’s natural to dislike the process of setting your consulting rates, but you shouldn’t have to give up money or sleep because of it. With a bit of know-how and practice, you can become confident in your value as a consultant and ensure your pricing reflects that.

Now that you know your consulting fees, you’re ready for launch—let us help get you across the finish line. Sign up for foundr+ for $1 to learn how to start a consulting agency. We’ll walk you through our proven roadmap for turning your talent into income.