For most startups, raising capital is the big hurdle to overcome — period. Without a decent runway, or a detailed roadmap to capital, insolvency is just around the corner. Countless startups have fallen victim to running short on cash, and not all of us can scrape by on credit cards as our runways.

That raises the question, how does a startup come up with funding in the early days, especially when it’s getting harder to raise money from VCs?

In the past decade, the new approaches to business creation, plus new technologies that lower the bar to entry for aspiring entrepreneurs, have sent the number of startups through the roof. And while it’s easier than ever to start a business, the problems startups are trying to solve are getting much tougher.

That means there’s going to be a serious need for new ways to fund your startup, and traditional venture capital simply won’t be able to keep up, nor is it well suited for every emerging business.

Fortunately, we’re also seeing new innovations in funding itself, namely the rise of crowdfunding, that have greatly expanded the options for startups needing to raise capital early on.

In this post, I’m going to break down the advantages and disadvantages of the two main kinds of funding—VC and crowdfunding, and then explore a new twist in the funding world that I believe can be especially powerful for aspiring entrepreneurs—equity crowdfunding.

Stay tuned, and you’ll walk away with a solid grasp of the leading options to fund your startup, and which one is best for you.

Starting a Business is Easier Than Ever, but Still Takes Money

Before breaking down the options, it’s important to explain how the funding landscape has changed in recent years, and as a result, why raising capital is becoming even more necessary and competitive.

First, the rise in accessible tools has enabled startups to become far easier to start. Today, $50,000 can easily build a simple MVP (Minimum Viable Product), even if you have zero coding skills. You can hire from Upwork, recruit some social media influencers, and make your budget stretch even further if you don’t mind living on the ramen noodle “Protein Fund” as Reddit’s Alexis Ohanian did . Going live is easier than ever, and you only need to click a button on Amazon Web Services to scale when growth kicks in.

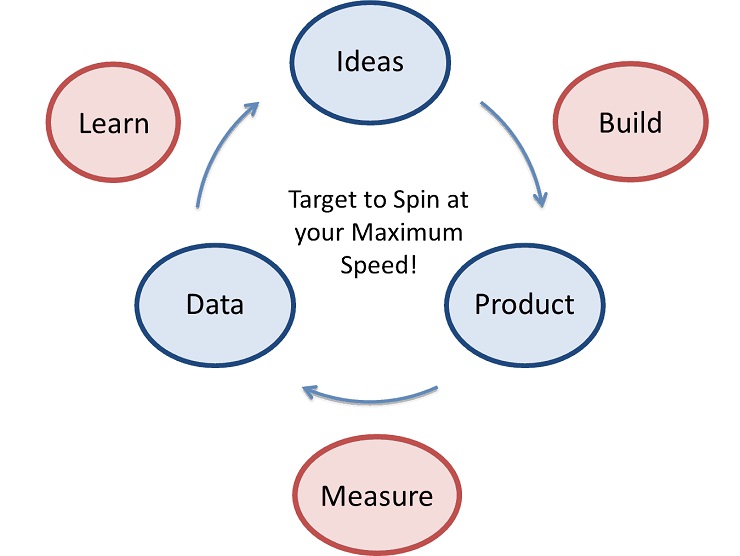

We’ve also seen the emergence of the Lean Startup methodology, which is based on insights from Eric Ries’s book The Lean Startup. According to Ries, this is “the Lean Startup is a new way of looking at the development of innovative new products that emphasizes fast iteration and customer insight, a huge vision, and great ambition, all at the same time.”

The chart below is straight out of the book and offers a good representation:

Source: The Lean Startup by Eric Ries.

The Lean Startup methodology has been embraced by startups, accelerators, incubators and even made its way into aspects of corporate life.

With the advent of new technology and the Lean Startup method, we’ve now had six years of “fail fast/grow fast” companies. Thousands of founders are now able to “give it a go” and build a product. Things are easier, but this also means VCs aren’t getting involved in startups as early on as they used to.

At the same time, startups are looking at more ambitious problems to solve. The “lean” period of a startup, in which new concepts are tested and iterated, is taking longer. This means more capital is required to get going and a longer runway is required, due to greater chances of mistakes and misfires.

I doubt the lean startup philosophy will change fundamentally any time soon, but I do think that startups in five years will be attempting to solve even more complex problems, requiring more capital, experience, and runway. The lean startup isn’t dead, but the “lean” period might be a lot longer and more challenging.

If the lean period is longer, can VCs support the community with more capital earlier on, or do we need something else to assist the new generation of startup founders?

Enter crowdfunding.

How to Fund Your Startup: Crowdfunding, Venture Capital, or Something New?

As you probably know, crowdfunding is essentially a platform where entrepreneurs and founders list their products and concepts in a campaign for 30 days and interested people can buy or support them with a pre-order or donation.

Normally, companies in this stage would look into VC funding, bank loans, debt equity, or family and friends to assist. Crowdfunding can open your company to potential clients and still offer family and friends an opportunity to assist.

There are pluses and minuses in taking the crowdfunding route when getting funding for your startup, and the common questions I hear on the matter include: Can crowdfunding and venture capital coexist? Is one better than the other?

My take is that each will continue to serve a distinct purpose for a long time, and new and aspiring entrepreneurs should put some time into understanding both approaches. That said, there’s also a new and growing approach, which I believe has potential to one day outperform even venture capital. It’s called equity crowdfunding, and through new platforms like Crowdcube, is making a big splash by allowing backers to own shares in a startup.

There is no formula for success to raising capital for the first time, so let’s deep dive into what went right and wrong for startup founders who have gone through these channels of funding:

- Crowdfunding (Kickstarter, Indiegogo, GoFundMe)

- Venture Capital ( Accel Partners, Index Ventures)

- Equity Crowdfunding (Crowdcube)

Let’s get into it.

Crowdfunding

Just five years ago, crowdfunding was a relatively small market of early adopters funding small projects on anything from new music to smart microwaves. Nowadays, campaign platforms like Kickstarter and GoFundMe provide a simple and effective way to raise awareness and capital for your company.

One of my favorite companies in the world was Pebble — the pioneering smart watch company that shipped over 2 million smartwatches around the globe. This company had it all: a sleek series of products, a dream team of developers, and thousands of apps on its smartwatch ecosystem. Pebble raised $43.4 million from crowdfunding platform Kickstarter, a record for most capital raised — ever. The company was two years ahead of the competition and most of all, had a millennial cult following.

What Pebble did right that you can also do

Let’s gloss over the bit where Pebble ran out of capital, wasn’t able to get VC interest, and was forced to sell assets to competitor Fitbit. Here is why Pebble was able to be so successful with crowdfunding:

- It went through an accelerator. Pebble’s sole founder Eric Migicovsky went through Y Combinator, which added validation and credibility to the founder and the product. Backers, more than ever, want to know that you can do what you say, and going through an accelerator definitely provides a level of comfort. There are hundreds of accelerators currently looking for startup founders, offering incentives like networks, customers, and capital. The popular accelerators in the US are Y Combinator, 500 Startups, and TechStars.

- It had a consumer-focused product. What tends to do well on Kickstarter is consumer-focused products. Electric skateboards, drones, video games, fashion labels, films, and music are all very successful projects that have been backed using sites like Kickstarter and GoFundMe.

- It had a simple concept video with no BS. The original video was straightforward, slightly funny, and included no nonsense.

Being successful in crowdfunding shows a market need, hones your branding, and delivers immediate access to capital, three of the most critical parts of a startup. Foundr’s own Jonathan Chan dived into this is an earlier article. But it’s not all puppies and balloons. All things in moderation.

Here’s my list of pros and cons for raising capital on crowdfunding platforms like Kickstarter.

Pros

- Simple to raise. No doubt crowdfunding is an easy way to gain access to a range of investors or backers.

- Super fast. Most campaigns last 30 days. The most successful make bank within hours of releasing their campaigns.

- Immediate customer base. As mentioned above, the most successful crowdfunding campaigns are consumer-focused. Usually when you back a consumer-focused company, you actually pre-order their product for a reduced rate or gain access to offers that you wouldn’t normally be a party to.

- Validation. Probably the most important part of any startup is validation of your product or service. One of the main points you’ll have to overcome when speaking with investors is market readiness and market fit.

Cons

- Lack of experienced mentors joining the team. One of the main reasons startups fail is incompetence — and it’s not surprising. Many founders have never run a company or managed teams, and have no idea what to do in certain situations. Most prominent VCs will assign trusted board members to add experience to youthful teams. With crowdfunding, you’re on your own.

- What happens when there is a fork in the road. All startups have “fork in the road” moments that could go one way or another. It could be which country to expand to, what feature to release next, or a pivot away from your current concept. Usually this means speaking to people who have gone through it before. You need trusted people around you to advise.

- Embarrassment if you fail. A crowdfunding campaign is open and in the public eye. When you get on the road for an investor roadshow, you can meet many investors and much of the process is a private negotiation away from the public eye.

- Failure rate after being extremely successful at crowdsourcing. And now we’re back to Pebble’s fate. This trend is getting more alarming. With big funding rounds comes an expectation to succeed. Pebble, Lily (Drones), Skully (AR helmets), Plastc (smart card) are all ambitious companies that raised over $10 million and are not around today. Some didn’t even ship a product to a single backer.

No doubt crowdfunding platforms like Kickstarter are providing a simple way for founders to showcase their concepts to an early adopter audience. However, venture capitalists have more often than not avoided investing in companies that have had some success from crowdfunding platforms. Reasons for this often stem from an investment mantra a VC firm will have in place and reluctance to deal with a swarm of potentially unsophisticated shareholders.

Now that we understand what crowdfunding can do, and potential tension with VCs, let’s go through some of the latest trends in the VC community and what venture capital can bring to your startup that crowdfunding may not.

Venture Capital

Venture Capital has been a proven business model for decades, but it’s often more than just capital. VCs are experienced, professional mentors and networkers. Having a notable and experienced VC can transform your startup with more than just money — just have a look a the original Tesla team .

Tesla was formed in 2003 with Martin Eberhard and Marc Tarpenning, who financed the company until Elon Musk came in with $7.5 million. Eberhard and Tarpenning already had drafted a note to shareholders that if the deal between Tesla and Musk didn’t happen, Tesla wouldn’t survive the holiday season. The understatement of the century is that adding Musk as an investor made an impact on Tesla.

The company had a few ups and downs, most notably in 2013 when Musk had to pitch in further capital to keep the company afloat, and negotiated a backstop funding round from Google’s Sergey Brin and Larry Page .

Some of the world’s greatest companies have relied on investors to provide network connections, experience, and know-how to chart a path toward being successful.

The number of times that I personally had late night phone calls to venture capitalists, sharing ideas, working connections, and generally keeping sane are countless. With traditional crowdfunding, you don’t immediately gain access to mentors.

So how do you get a VC in your corner?

Venture capitalists are here to make money and invest in high risk, high return, early stage companies. They invest in things they see value in or are aligned with their investment mantras. If they aren’t happy with progress or the direction of the company, they will use their influence to steer a company toward their way of thinking. This is one reason many people are cautious when bringing a venture capitalist onboard.

However, the positives more often than not outweigh the negatives in my experience.

Pros:

- Capital. Obviously. Venture capital dollars can far surpass what you can acquire via debt capital and more often that not crowdfunding. Many VCs have portfolios that range in the billions of dollars.

- Experience and networks. VCs are professionals and often have started one or multiple successful businesses. Often experience can provide new opportunities, sound strategy, and a different approach.

- Ability to help in tough times. Like Tesla, VCs are able to offer capital or debt-equity solutions to get your company through down times. Apple, Tesla, Uber have all relied on VC’s to get through rough patches.

- Value. Being a VC-funded startup brings instant credibility. If you are backed by a known and well-established VC firm, partnership opportunities, end users, or even other VCs will be interested to speak with you. Things generally come easier.

Cons:

- Unintended Sabotage. If you fall on multiple hard times, don’t have a market fit, or are trending towards insolvency, VCs will not hesitate to take action. If your company tanks, VCs will look toward assets to sell off and “repay” themselves.

- Loss of control. Naturally when you accept venture capital, VCs are buying into your company and that means equity. Should you need to raise a lot of capital, you’re own equity will diminish. Traditional crowdfunding uses pre-orders, rather than equity.

- Strategic directives. Many VCs have a series of backers that fund their firms. Many of those backers hand down specific requirements besides the usual: make me money. We’ve seen corporate VCs block acquisition offers or financing rounds that may have been advantageous for the company or the founders.

- Non-standard terms. Some VCs hedge risk by offering non-standard term sheets that protect their investment. Should the term sheet play out differently than the VC’s expectations, they are in the driver’s seat to do as they wish. A common and potentially dangerous term is the “first right of refusal to acquire your company,” which limits the company’s options to be acquired or raise future capital.

Next up, there is a relatively new approach to funding that has started picking up traction as economies of the world look to stimulate their startup communities. It’s a close cousin of the crowdfunding platforms I discussed above, and it’s called “Equity Crowdfunding.”

Equity Crowdfunding

Traditional crowdfunding platforms promote campaigns about your product, and when you back a campaign, you normally pre-order the product. Equity crowdfunding can do this too. However, when you back an equity crowdfunding campaign, you guessed it, you buy a pre-order and shares in the company at the same time.

Crowdfunders like Kickstarter haven’t really ventured into equity funding, due to the fact that it adds another layer of complication into the business model and limits the amount of possible funded opportunities towards mainly companies with products, rather than music albums, journalism pieces or photography.

Enter Equity Crowdfunding.

Another favorite company of mine is Monzo — a digital bank in the UK for people with smartphones. Simple concept, but building a bank is one of the most challenging things you can ever do, unless you are extremely different from the competition. That’s what Monzo banked on.

Monzo has been around since mid-2015, and as of the start of 2017, had £30 million in venture capital. Why would Monzo need to look at crowdfunding ? Because they want to be like a community bank and let the customers have some stake in the game.

So last month, Monzo started a campaign on Crowdcube, a UK-based platform for crowdfunding that allows backers to obtain a piece of equity in the startup. Monzo’s campaign offered a chance to invest in the company with a £2.4 million target. After the round was closed in 20 minutes, the founders let it go a little longer and after an hour raised £22 million.

This was by far the largest sum in crowdsourcing history , eclipsing Pebble’s $10 million Kickstarter.

Here is Monzo’s 2017 Crowdcube Pitch:

Crowdcube was at the right place at the right time, and as the UK government relaxed laws on equity-based regulations, the company took off. Due to the fact that there is equity at stake, signing up for Crowdcube does take longer, and due diligence is conducted by Crowdcube before you can launch your campaign. But there’s a lot of potential in this emerging model of fundraising.

The initial consensus surrounding equity crowdfunding is that it’s only for growth-stage companies looking to “top up” their cash reserves . This couldn’t be further from the truth, with a host of businesses soft-launching using Crowdcube, and setting up similar campaigns that would work just as well on Kickstarter.

One main difference is that Crowdcube is attracting venture capitalists to invest, since much of the due diligence normally being conducted by VCs is readily available as part of the campaign.

A common benefit from both crowdfunding methods is you don’t need to be a millionaire to invest. I’ve invested in a few startups, and the common minimum investment term was $25,000. With crowdfunding, you can invest from as little as $25. Some regulations in countries suggest a minimum of $2,000, but compared to $25,000, that’s affordable. It’s normal for your family and friends to assist and an equity crowdfunding platform offers a simple way for your friends to back you.

Let’s look at what Monzo did right using Crowdcube.

- Effective media content. Monzo was very active with blogging, being active on communal slack channels and consistent in using social media about getting word out. As part of the content, Monzo crafted a simple post about the company’s progress, vision, and user growth.

- Plenty of due diligence available. Monzo had lots of corporate documentation, financial statements, and other due diligence documentation at its disposal. Much of this material would have been developed from previous capital raisings.

- Already raised capital. This is a big one. In investment circles, credibility is everything. If you don’t have it, you have to show tremendous user growth or amazing partners. Monzo had both and already raised £7m in Seed and Series A funding before raising the first £1m from Crowdcube.

The pros and cons of crowdfunding are similar to equity crowdfunding, so I thought I’d go over how equity crowdfunding differs in process.

How equity crowdfunding works:

- The Setup. Your startup creates an online profile and submits a funding campaign for the platform to analysis and conduct due diligence. This includes basics like company numbers, founder bios, market analysis, and corporate documentation.

- The Approval. The equity crowdfunding platform reviews and approves your campaign. Sometimes the review will require further due diligence documentations to meet the risk criteria. The turnaround time can be as fast as a few days.

- Campaign Launch. Investors and backers review your campaign and commit to invest or pre-order.

- Campaign Completed. If your campaign is successful, investor officially commits, documents signed and funds are transferred.

I feel equity crowdfunding will provide a best of both worlds, where both family and friends, as well as VCs can support startups looking for capital, if done correctly.

The last thing a VC will want is thousands of shareholders to manage. However, the right investment instrument and timing can ease the pain of dealing with thousands of shareholders, while enabling the founders to concentrate on their business.

Final Tips and Suggestions On How To Fund Your Startup

I’ve met a lot of VCs, private equity firms, and sophisticated investors. Most of which are quite smart and educated people.

Investing via crowdfunding platforms without equity can be risky from a backer’s or investor’s perspective, especially if there is little due diligence before investing. However, equity crowdfunding provides the best of both worlds.

Equity crowdfunding offers a reasonably fast and efficient way to get your startup’s name out, prompts you to get your branding and vision together, and offers a safe and sophisticated platform for you to raise capital and grow pre-orders.

Venture capitalists are now starting to pay attention to equity crowdfunding, and with a host of trailblazers enabling both interested parties, family and friends, and VCs to invest. I believe we’ll see equity crowdfunding pass traditional VC investment in total investments shortly.

I certainly wish equity crowdfunding was around when I raised my early stage capital.

I’d love to hear some comments from founders who have gone through equity crowdfunding, or other forms of early fundraising for that matter. Please let us know below!