There’s nothing more frustrating as an entrepreneur than having a million-dollar idea but no guidance on how to raise the capital to get that idea off the ground.

In any case, we all can’t get a gig on Shark Tank, pitch our idea to the sharks, get berated by Mr. Wonderful for 30 minutes, only for him to completely ignore our asks, and offer us a terrible deal and 10 seconds to decide.

Actually, that sounds like a terrible experience.

But pitching ideas off-camera can be just as tricky. Attempting to get them to see your product or service from the same lens you do is hard, but the result can be that vital funding you need to kickstart your business.

In this article, I will refrain from sharing my thoughts on Mr Wonderful’s behavior momentarily and instead provide you with all the information you need to develop a million-dollar pitch deck for potential investors.

And you can access it for 99.99% royalties in your business in return for a small loan with a 90% interest rate.

Just kidding, there will be no sharking here.

First Off, What Is a Pitch Deck?

Before we get started with what to include in your pitch deck, let’s give the phrase a clear definition.

In simple terms, a pitch deck is a clear and concise presentation you provide to potential investors in the hope that it will entice them to invest in your business idea in return for some form of remuneration, often as a percentage of the business.

An effective pitch deck will captivate the audience, inspire them to become passionate about what is being presented, and hold them to their every word.

Much like this article.

Right?

When done well, pitch decks can help you find new investors and partners and drum up funding and excitement for a new product or service.

Don’t Skip: Series Funding for Startups – Terms and Jargon Explained

6 Things to Include in Your Pitch Deck

With that in mind, let’s look at some of the most important elements of any successful pitch deck.

1. The Problem Statement

For starters, you need the investors to see the problem at hand. This is the “paint the picture phase” of your pitch and should highlight the pain points that people are currently suffering from.

2. Your Solution

“If only there was a way to solve that problem.”

The potential investors might not say it out loud, but you can see it in their eyes. That’s when you provide your clear and concise solution to said problem. Explain how your product or service effectively addresses the identified problem and provides value to users.

3. What Sets You Apart

“But how does that differ from x, or y, or z?”

Those pesky eyes are giving away your audience’s thoughts once more. That is why the next step is so important, and it is where you articulate what sets your solution apart from existing alternatives in the market.

Here, you should highlight key features, benefits, and advantages that differentiate your offering and put x, y, and even z current solutions in the market to shame.

4. The Market Opportunity

Now that your audience is hooked and fully bought into the concept of what you are suggesting, it’s time to provide insights into the size and potential of the target market to really get them excited about the potential of this business venture.

Include data on market trends, growth projections, and any relevant statistics that support the opportunity for your business.

5. Your Business Model

But investors aren’t just interested in the potential reach of a new venture; they also want to hear how you anticipate it will become profitable.

After all, no one wants to invest in a business that doesn’t return a profit.

It’s important to be realistic here and manage expectations rather than providing delusions of grandeur.

Many investors would rather hear you think profits will be minimal at first, rather than stating the company will be worth an obscene amount in a short space of time. Those kind of valuations often harm your credibility and can mean you lose your audience.

6. Your Investment Ask

Finish your pitch deck by clearly stating the amount of funding you are seeking and how you intend to utilize it. Be transparent about the use of funds and the potential return on investment, and go into any meetings with a clear understanding of what you are willing to compromise on and which elements you are unwilling to waiver on.

Pitch Deck Design Must-Haves

There’s nothing more disengaging than a poorly put-together PowerPoint presentation. I’m sure you can remember a moment at school when the teacher was reading off the screen, and you almost hit your head on the table as you slowly drifted to sleep.

Yeah, that’s not the response you’re going for in an investment meeting. It tends to result in a “no.”

I even made a little statement about this: “If they snore, it’s a no for sure.”

As Alexa von Tobel, founder of Inspired Capital, explains in her Finance for Founders course, she’s seen hundreds of formal pitches, spending time on both sides of the table. This experience has allowed her to break down some key takeaways to help you make the perfect pitch deck.

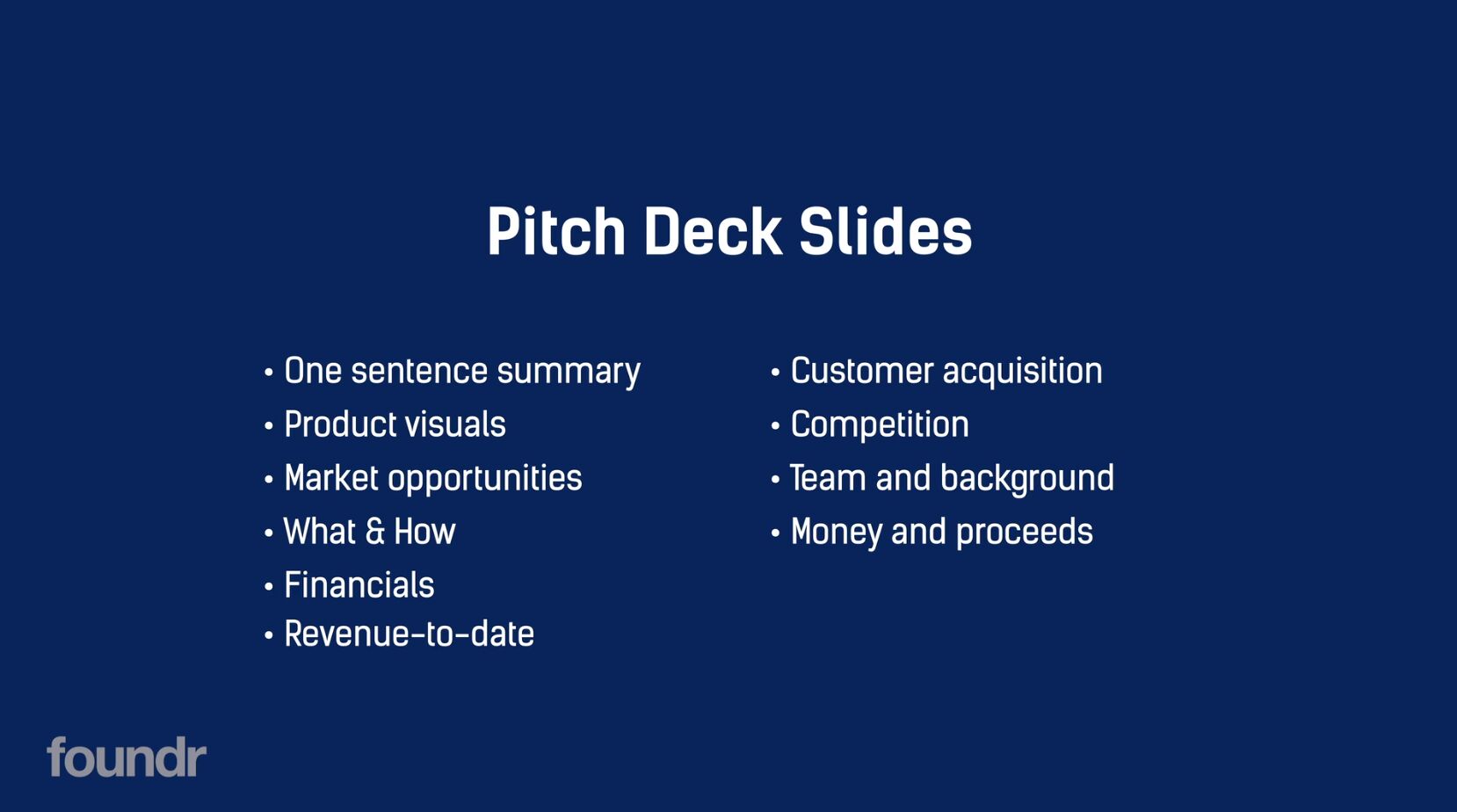

Keep it simple, around 12 – 15 slides. The slides should include the following:

- Slide #1: A one-sentence summary of your product.

- Slide #2: Visuals of products, exactly what you’re selling.

- Slide #3: How big is the market opportunity, how many customers would use it, and how much revenue do you expect?

- Slide #4: What you will build and how you’ll get there.

- Slide #5: Financial plans.

- Slide #6: What have you done to date, what revenue have you made on this product already, and is there proof that your idea will work?

- Slide #7: How to get customers and how to roll out your product.

- Slide #8: Your competition; why you’re better and different.

- Slide #10: You and your team: your background and your team’s background and why you’re all awesome.

- Slide #11: Money and proceeds: How much money do you want to raise, how will you use it, and where is the money going?

- Slide #12: Appendix: all of the questions that pop up when you present this to your five smartest friends.

Pitch Deck Examples

To find some of the very best pitch decks to learn from, check out Piktochart’s great article, which covers 33 legendary startup pitch deck examples.

These examples cover some of the biggest companies, such as Facebook, Airbnb, and LinkedIn.

Keep Learning: 5 Proven Business Truths from Startup Entrepreneurs Who’ve Done It

Build Your Business with Founders Who’ve Been In Your Shoes

Setting up and scaling a business can feel incredibly tough and often extremely lonely, even for the very best entrepreneurs.

Fortunately, it doesn’t have to feel like this with our foundr+ membership: Here, you’ll gain access to world-renowned, proven instructors and frameworks and a like-minded community of self-driven entrepreneurs to bounce ideas off and use as inspiration.

Check out the foundr+ membership today and start taking your ecommerce business to the next level.