Running your business can be incredibly fulfilling.

Creating innovative products, determining the path your business takes, and being a kickass entrepreneur on the daily.

But when it comes to the numbers, things aren’t quite so fun.

Those pesky numbers.

Any business owner will tell you that keeping up with all the administrative requirements can get quite frustrating after a while.

One admin job that often slips under the radar despite its importance is your company’s profit and loss statement.

Here, we will dive deeper into what your P and L statement should look like when you should submit it and everything in between.

Short on time? Here are the key takeaways

- A P and L statement is a financial statement that covers your company’s revenues, expenses and costs on a quarterly basis.

- P and L statements must be submitted by a public company.

- You can prepare a P and L statement using a cash or accrual method.

What Is a Profit and Loss (P and L) Statement?

Let’s dive straight in, shall we?

In simple terms, a P and L statement is a financial statement that gets submitted each quarter, outlining revenue, cost, and expenses during that period.

This statement provides an insight into a company’s profitability and is often shown as a cash figure.

Companies and their investors often refer to those P and L statements to establish how financially healthy a company is.

Don’t Skip: The Best Profit Margin Formulas for Your Business

How Profit and Loss (P and L) Statements Work

As mentioned, P and L statements are submitted quarterly, alongside an annual topline as well. They are accompanied by a separate cash flow statement and balance sheet.

You might’ve seen the term P and L before without even realizing it, as it can often get referred to in a wide variety of ways, including:

- Income statement

- Earnings statement

- Statement of profit and loss

- Statement of operations

“Your income statement is probably one of the most strategical statements that you should really look at and understand.” – Alexa von Tobel

“Your income statement is probably one of the most strategical statements that you should really look at and understand.”

A P&L can be prepared in two distinct ways, either as a cash statement or via the accrual method.

Cash Statement

The cash method is the simplest way to produce a P and L statement, taking into account when cash goes in and out of your business.

This method is ideal for smaller companies or freelancers who want to be in control of their finances.

The Accrual Method

The other option is the accrual method, which records revenue when it is earned. That means accounting for money your business expects to receive in the future.

Now, that doesn’t mean you can run a loss, only to assume that at some point Elon Musk will see your fervent efforts and invest a casual $1M (would be nice, though, wouldn’t it?).

No, what this refers to is when your company provides a product or service at an agreed price and is still awaiting that contractually agreed payment. The same would also go for any future expenses.

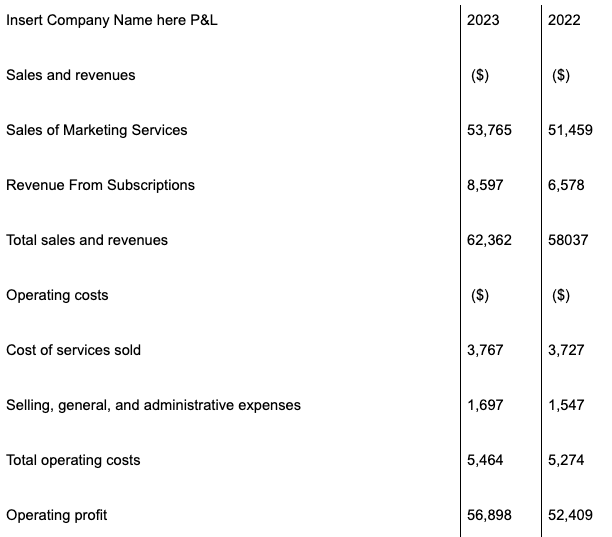

Profit and Loss (P and L) Statement Template

Now, that’s quite a lot of information to digest in one sitting!

So, to make things a little easier, below is a basic P and L Template for you to follow to help add a visual to the information above. For more advanced statements (which may be required in some instances), check out Amazon’s P and L or Walmart’s P and L, both of which Alexa von Tobel covers in great detail as part of our Finance for Founders training.

Here’s the P and L template in Google Forms.

Why Are Profit and Loss (P and L) Statements Important?

Now, all that information is great, but why is a P and L statement so important? After all, if you know the business is profitable, and you have tracked incomings and outgoings accordingly, why do you need to spend the additional time putting all that into a statement?

Well, for starters, if you run a publicly traded company, it is required by law. This law ensures any potential regulators, investors, or analysts can review your figures and ensure you’re keeping everything above board.

Secondly, it is a great way to gain a visual representation of how your business is growing or where potential money pits are developing year after year. Running your own business is hectic at the best of times, so having a clear and concise top line that allows you to compare to prior months and years is a great way to keep everything on track.

And lastly, you’ll typically need to produce a P and L statement if you are pitching to investors, as they will require this level of detail before considering your brand.

After all, any investor not only wants to get full clarity over your current profitability, but they also want to see that you are highly organized and professional, and take your business seriously.

Keep Learning: Annual Recurring Revenue – Calculate Your Subscription Revenue

Take Your Business to the Next Level

P and L statements are just one element of your business that you need to get to grips with. Fortunately, we’ve got all the answers you need within our catalog of free training.

Say goodbye to headaches and confusion, and hello to clarity and productivity.