Starting a business is an inherently optimistic endeavor. Despite the odds, we entrepreneurs do everything in our power to set ourselves up for success, hoping that our business will defy the statistics and be among the minority that makes it past the 10-year mark.

But if we’re so concerned about success, why is it that so many of us place so much intense focus on our online business ideas, but ignore the tried-and-true business plan? Research has shown that having a business plan can boost your average annual growth by 30% and increase your chances of succeeding by 16%!

EXCLUSIVE FREE TRAINING: Successful Founders Teach You How to Start and Grow an Online Business

There’s a lot of debate in the entrepreneurial world about whether business plans are valuable, and while we at Foundr are certainly all about execution, we’re not about to argue with what the research clearly shows about the benefits of proper planning.

And before you think, “I’m just starting out—what good is a business plan for me?” I feel you.

When I started my business in 2013, I didn’t have a plan, much less a formal business plan. And guess what? Three months into it, I ran out of money. I didn’t know who my clients were or how to find them because I had never put much thought into it. I flip-flopped among several seemingly unrelated services (videography, photography, copywriting, and more).

Thankfully, I have since streamlined my services and am about to celebrate six years in business, but I think I could’ve avoided many mistakes if I had at least made a simple business plan for myself when I started.

To help you have the best chances of succeeding in your business, I’ll walk you through the basic components of a business plan.

What Is a Business Plan and Why Do You Need One?

A business plan is a roadmap for where you want your business to go. It can be one page or multiple pages, but at its core, it answers:

- What is your business?

- Who does it serve?

- What does it sell?

- How will it make money?

- How will it stand out in the market?

- What are its plans for growth?

While it’s not required when starting a business, having a business plan is helpful for a few reasons:

- It can help you get bank loans. Before approving you for a business loan, banks will want to see that your business is legitimate and able to repay the loan. This will usually require that you provide them with a business plan to review.

- It can help you win over investors. Similar to the banks above, investors want to know that they’re making a promising investment when they lend you money.

- It can help you stay focused. Having a business plan that outlines your target audience, your mission, the services you offer, and more, can help you make sure you’re staying focused on your overall goals for your business. For example, maybe you’re a content marketing agency and you’re toying with the idea of adding on branding as a service you provide. A quick glance at your business plan might remind you that that’s not why you started this business. Your business plan can prevent you from wasting time and resources on something that isn’t aligned with your business goals.

- It can help your business succeed. One study of more than 1,000 aspiring entrepreneurs over a six-year period found that those who created a formal business plan were 16% more likely to achieve viability than those who didn’t plan.

As you can see, planning can pay off—especially if you’re seeking funding.

Who Are You Writing Your Business Plan for?

Before you begin writing your business plan, consider your audience. A business plan will be written differently depending on who’s going to end up reading it. Bankers, for instance, have different motivations than equity investors (venture capital fund managers and angel investors).

In this review of the literature, researchers found that bankers are most concerned about whether you can repay the loan; therefore, they’re more likely to scrutinize the financial section, looking for good cash flow and the opportunity for taking collateral.

VCs and angel investors, on the other hand, are more interested in potential growth and return on investment; so they’ll likely focus on your capabilities, the service you’re offering or the product you’re selling, and the market you want to enter.

If you’re simply creating a business plan to help you stay focused on your business goals, then you’re more likely to write about your plans for the future and milestones you want to reach, rather than any history or track record.

EXCLUSIVE FREE TRAINING: Successful Founders Teach You How to Start and Grow an Online Business

Basic Components of a Business Plan

Business plans vary depending on the business and its audience, but below are some of the basic components of a business plan that apply across the board.

Executive Summary

Begin with an executive summary that introduces the reader to your business and gives them an overview of what’s inside the business plan.

Here’s an excerpt from the U.S. Small Business Administration’s example consulting business plan:

We Can Do It Consulting provides consultation services to small- and medium-sized companies. Our services include office management and business process re engineering to improve efficiency and reduce administrative costs.

Business Description

In this section, you can dive deeper into the elements of your business, including answering:

- What’s your business structure? Sole proprietorship, LLC, corporation, etc.

- Where is it located?

- Who owns the business? Does it have employees?

- What problem does it solve, and how?

- What’s your mission statement? Your mission statement succinctly describes why you are in business. To write a proper mission statement, brainstorm what your business’ core values are and who you serve.

Here’s an example of an ecommerce business’ mission:

Liquid Culture’s mission is to present consumers with designs, styling and clothes that energizes any outdoor activity. Whether it be snowboarding, running along the beach, or drifting down a river, Liquid Culture has comfortable, durable clothing that will look and feel wonderful.

Market Analysis

Before starting a business, you want to make sure you understand the market you’re entering. Is your target market large enough that you can make enough money? Is the market already saturated with products and services like yours? How will you stand out? Investors will be interested in seeing what you put here because this will help them become confident that you know what you’re getting into and that your business has the potential to grow.

The market analysis section will answer:

- Who are your competitors? Do your research and find out who your competitors are. This is important, because it will help you understand your market and know how you’ll differentiate your business from similar ones out there.

- What’s your unique value proposition? Your unique value proposition (UVP) is the thing that makes you stand out from your competitors. This is your key to success. If you don’t have a UVP, you don’t have a way to take on competitors who are already in this space. Here’s an example of an ecommerce internet business plan outlining their competitive edge:

FireStarters’ competitive advantage is offering product lines that make a statement but won’t leave you broke. The major brands are expensive and not distinctive enough to satisfy the changing taste of our target customers. FireStarters offers products that are just ahead of the curve and so affordable that our customers will return to the website often to check out what’s new.

- Who’s your target audience? This describes the people you serve and sell your product to. Be careful not to go too broad here, thus falling into the common entrepreneurial trap of trying to sell to everyone and thereby not differentiating yourself enough to survive the competition. Below is an excerpt of a market analysis section from this sample consulting business plan. Notice how detailed it gets, including specifying the target customer’s business worth and growth rate.

The target customer owns a small business, and is generally dissatisfied with the revenue that the business is generating, or is dissatisfied with the daily management of their business. The customer is likely to operate a business worth between $200K and $10 million, with growth rates of between 1-10%, or even a negative growth rate.

Products and Services

Writing this section is pretty straightforward, detailing exactly what you’ll be selling.

- What services will you sell? Describe the services you provide and how these will help your target audience.

- What products will you sell? Describe your products (and types if applicable) and how they will solve a need for your target and provide value.

- How much will you charge for your products and services? If you’re selling services, will you charge hourly, per project, retainer, or a mixture of all of these? If you’re selling products, what are the price ranges?

Marketing

In this section, you’ll outline your marketing strategy to ensure you have a plan to get clients and customers and make money.

- How will you get new clients and customers? Will it involve social media, blogging, cold calling, email marketing, paid advertising, referrals? Here’s an excerpt from a custom printed T-shirt business plan sample, in which the company has identified advertising as part of its marketing and sales strategy:

Your T-Shirt! will run ads in several teen/young adult magazines whose readership demographics are similar to Your T-Shirt!’s.

- How will you retain clients and customers? Do you have a plan for increasing your customer loyalty to keep them coming back to you?

- What’s your marketing budget?

Financial

This section is particularly important if you wish to secure a bank loan or investors’ money. If you’ve been in business for a while, you can include past revenue. If you’re brand new, you’ll have to forecast your revenue.

The financial section can include many types of forecasting and graphs, but a few common ones are:

- Profit & Loss (P&L) statement – This details your income and expenses over a given period.

- Expenses – List the expenses you expect your business to incur.

- Cash flow statement – Similar to the P&L, but this one will show all cash that flows into and out of the business each month.

Business Plan Templates and Examples

To better understand what you need to put into each component of your business plan, it can help to look at examples. Here are some free resources that can help:

- PandaDoc has some free business plan templates that include descriptions of what to put in each section.

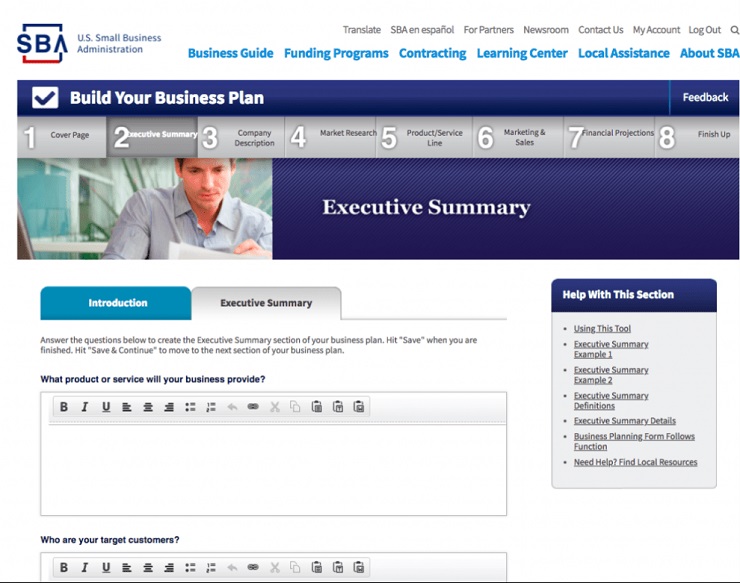

- The U.S Small Business Administration has example business plans that you can look at for inspiration. There’s even an online tool to help you build your business plan.

- Bplans has a library of more than 500 sample business plans for almost every industry.

Final Thoughts on Creating a Business Plan

- Don’t let creating a business plan hold you back from actually starting your business. If you find you’re getting stuck on perfecting your document, opt for a simple one-page business plan—and then get to work.

- Remember, business plans are not a requirement for starting a business. They’re only truly essential if a bank or investor is asking to see one.

- Ask people to review your business plan. It can be helpful to have an extra set of eyes on your business plan to make sure it’s in the best shape possible. Be sure to ask someone who knows your business, such as a mentor or business partner.

- Businesses change—business plans can too! While, yes, a business plan should guide you as you grow your business, it should not restrict you or dictate your every move. For example, you may find that your mission has changed; in that case, you can and should modify your business plan to reflect that.

EXCLUSIVE FREE TRAINING: Successful Founders Teach You How to Start and Grow an Online Business

Ready to Write Your Business Plan?

By now, I hope you’re ready to blast through creating your business plan so you can move on to the fun part: building your business.

To recap, here are the basic components of a business plan:

- Executive summary

- Business description

- Market analysis

- Services

- Marketing

- Financial

Remember, the purpose of a business plan is to secure funding or serve as a guide for you (or both). Don’t get stuck on this step. You can always revisit and revise your business plan later. What’s most important is that you take action now.

Have you created a business plan? Share any advice you have for your fellow entrepreneurs in the comments below!