For many entrepreneurs, selling a business is the ultimate prize—a windfall after years of struggle, or at least a ticket to your next big project. But if you’re not ready for it, a sale can fall to pieces. Follow these steps, and you’ll be on the road to a profitable business exit, not to mention a company that’s running like a finely tuned machine.

While a ton of thought goes into getting the process of getting a business off the ground, far less is written about the highly stressful and delicate process of preparing to sell a business.

What are the steps? What are buyers looking for? Where can you screw up? These are questions that need answers if you are going to sell your business.

Why is selling and preparing for a sale so important for any entrepreneur? Selling your business can lead to a lot of new opportunities for you. After all, an online business in particular typically fetches 20 to 40 times the net monthly profit of the business. That kind of capital can lead you to a new, bolder, and more ambitious project. Or it can be a good down payment (or even the entire payment) for a real estate property, or another investment.

The way to get to the higher end of that range comes down to how you actually prepare the business for sale. That process actually starts on day one of any business. If you haven’t already, you can read my first post in this little mini-series that talks about the fundamentals you should have in place early on.

Even if you’re not looking to sell your business (maybe you’ve just started!), both that post and this one will still be valuable to you. A lot of what goes into preparing your business for a sale is also going to make your business better and more efficient, and we all want to learn to be more productive.

In this installment, we detail the more advanced things you can put into place before you start courting buyers for your business. We will dive into what to do six months out from selling, three months out from selling and 30 days out from selling. The earlier you start the better, so you are prepared instead of scrambling around, trying to gather data you may not have.

So bookmark this page, whip out a notepad or Google doc, and and let’s dive in.

Selling Your Business for a Big Payday: What to Do Six Months Out

You are now six months out from selling your business. You have prepared your business, tracked your numbers, outlined your standard operating procedures, and you are happy with what your business is currently valued at.

Now is the time to run a fine-toothed comb over your business to make it even more attractive to a potential buyer.

Here’s what to do at the six-month mark.

Check for Duplicate Content and Product Listings

Duplicate content can come in many forms; most people who do any kind of SEO will be familiar with the penalty that Google gives if they discover your exact content on another person’s site. Being in the doghouse with Google will hinder your ability to sell for the price you want.

You may not be copying content from other sites, but that doesn’t mean your competitors haven’t attempted to do so with your site. Run your website content through a service like Copyscape, which will search the internet for content that is the same as yours.

If you do happen to find that someone has stolen your content, reach out to them and ask them to take it down. Obviously, the more that piece of writing acts as a an important place to convert traffic into customers for your business, the more you should try to get the duplicate content taken down (especially if you spent good money on copywriting to make that sales letter convert).

Often the easiest solution will be to just change up your original content a bit—perhaps a minor rewrite, as most people who have flat out stolen your content are probably going be less responsive than you would hope. That said, I would only recommend rewriting an article if it’s not a super important page that you’ve invested a lot of copywriting into already. Rewriting informational articles like this one is cheap and avoids the hassle of having to convince someone to take down the content they scraped off your site.

If you DO have an important page of your website that has been stolen by another, you can do a full DMCA request with Google. This is a rare issue, so it’s unlikely to happen to you. Doing a full DMCA should get that content yanked from Google results and may even penalize that site heavily. It is always worthwhile to reach out to the site owner first, but if they won’t, you can use this last ditch effort to get that content taken down.

On another note, if you have a big ecommerce store with hundreds of products, it is worth going through your entire website to make sure you don’t have any duplicate product listings. This can happen unintentionally, especially on bigger sites, and it’s best to clean these up before you try to sell.

Make Sure Links to Your Site Are High Quality for Healthy SEO

The quality of links directing people to your site, otherwise known as a link profile, is still one of the most important parts of ranking within Google, and a lot of low-quality links can negatively impact your site (though less so now with the new Penguin update).

Savvy buyers are often sensitive to a bad link profile, for good reason. If a website’s main traffic is organic from Google searches, then it is even more important your link profile looks good.

Mainly, you want to watch out for links to your site from really spammy sources. That can mean directory links; links from porn, gambling, or pharmaceutical sites; or otherwise shady sites, like something with no real value but a ton of affiliate links.

A good rule of thumb for avoiding bad links to your site is that any high-quality backlinking usually can’t be automated. Anything that involves a ton of junk sites thrown up overnight with links back to you fall in the category of “black-hat SEO.” That’s a big problem if a buyer is looking to buy your company.

You can use tools like Ahrefs, Majestic SEO, SEM Rush or SEO Moz to check your backlink profile for these types of links. If you find your site has them, then it’s time to hop over to Google’s Disavow Tool. While disavowing isn’t as important as it used to be, it is a still good idea to let Google know you had nothing to do with these junk links.

There’s a good post you can read here for a deeper dive on important SEO metrics.

Make Sure Your Vendors are in Good Shape

If you are selling a physical product, there are a few things related to the vendors you contract with that you want to get in line at this point in your preparation:

- Make sure your dropship supplier agrees that all terms they have given you are transferable to the new owner. Get this in writing. It can kill the deal when an entrepreneur realizes that their dropship supplier is not going to transfer their agreements over to the new owner.

- Make sure you have multiple suppliers for your products If you have only one supplier, that supplier could hijack you with prices or if their ability to create your product is limited you won’t be able to have enough inventory for the demand.

- Use a tool like TimeDoctor to track how much time you are spending on customer service.

- Outsource customer service as soon as possible.

While the last two apply to any business, businesses that are sourcing their own products seem to fall into the customer service trap more often, not outsourcing it and not figuring out how much time it actually takes to provide service to their customers.

Remember, a savvy buyer isn’t looking to buy a job; they’re looking to buy an asset.

What to Do Three Months Out From Your Big Exit

We are getting down to the wire now. This is really one of the last chances you will have to do anything significant enough to affect your valuation. Most of the stuff you will prepare in this time period should not take nearly as much work as your previous groundwork. If you’ve done things right, you will just be updating the preparation you’ve already completed.

Update Procedures—Have Systems Changed? Should They Change?

Take a good hard look at all the standard operating procedures you have created for your business. Are they still relevant? Has your business grown to the point where the SOPs no longer make sense? If so, you will want to change these to reflect the current operations.

An example of this here at Empire Flippers is the shift from when we used to sell sites earning less than a $1,000 per month. As our company grew, we realized we were spending way more time vetting and servicing these smaller sites, so we updated our SOPs to accept only sites that are making over a $1,000 per month in net profit (with some exceptions).

Clear Up Terms of Service—Make Them Relevant to the Present Day

Similar to SOPs, you want to make sure your terms of service (ToS) reflect where your business stands today, not where it stood over a year ago.

Maybe you run a client business and when you first started out, you had no exclusivity clause in any of your client contracts, but now you have a well-oiled service agency that will only accept clients if they sign six-month contracts. This type of thing is important to mention in your terms of service. Give them a good read and see if there is anything that is now irrelevant or has changed in your business.

Review Your Financials—Where is the Money Trending?

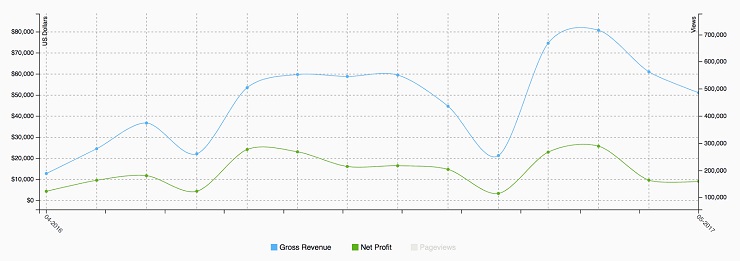

This should be easy if you have followed the steps mentioned in Part 1 of this article, where you created your own separate bank account for the business with detailed P&Ls. Load the numbers up into your favorite spreadsheet program and create a graph, or have your bookkeeper do it for you if you don’t want to get lost in the wild cells of Excel or Google Sheets.

This graph will be an easy visual to help you figure out where your business is trending as you get ready to sell. The best-case scenario is an upward trend; it doesn’t have to be meteoric, but an upward trend is simply going be easier to sell.

This is also a good time to see if there is any big spikes or dips in your earnings. Try to figure out what was happening during that period. If you kept good monthly notes, this should be relatively easy. It is good to refresh yourself with what is happening and be able to explain any anomalies when it comes time to sell. Consolidate these notes into a word doc, so you can easily reference them should a prospective buyer have any questions.

Review Your Traffic—Where are the People Trending?

Reviewing traffic data should be even easier than looking at your financials since you should at this point have Google Analytics or Clicky installed on your website.

Dig through analytics and look at:

- Whether your traffic is trending up or down

- Your main traffic sources and what percentage of total traffic they make up (e.g. Google organic 73%, Facebook paid 27%)

- Your top ranking keywords

- Your bounce rate

- User behavior. Are people clicking through other pages on your site, leaving your site, or directly going to your affiliate links/order pages?

It is helpful for a buyer to know these things so that they can apply their strengths once they purchase your business. They might see a website that is getting a large amount of traffic but is earning very little. The traffic trend on this site might be skyrocketing, but the earnings may not be increasing as dramatically.

A savvy buyer might surmise that this is because of an inherent conversion rate optimization problem, buy your business, do some tweaking, and increase the earnings of their new asset overnight.

Outsource, Outsource, Outsource!

If you haven’t picked up on this motif yet, hopefully now you will. Three months is still enough time for you to really start building out a totally outsourced business (or at least as much as is possible). There is still enough time to train new contractors on how to do their jobs, measure their results, and adapt your processes to perfect the system.

You can outsource almost every process of your business:

- Outreach for link building

- Social media profiles

- Quality control for ecommerce business products. Not outsourcing this portion of a business is another common mistake we see sellers make, and it’s easily fixable with a third party company.

- Customer service

- Reordering of your products, which can be handled fairly easily by a trained VA

Decide How Much Support You’ll Give Your Buyer

Now is the time to consider what kind of backup you are going to give to the new owner. Typically, 30 days of support with unlimited email and one to two hours of Skype calls per week during that period is going to be enough.

It is worth noting though, that the more complex your business is, the more support you are going to need to offer. The support needed by someone who buys an affiliate content site from you is going to be a lot less than that required by the purchaser of a large SaaS product, for instance. This is especially true as your business grows larger, gains a team, systems, and technological infrastructure in place that the buyer needs to be trained up on.

Write down what you are willing to offer in terms of support, but also write down what you are unwilling to do as far as support goes. Just like you want to have a hard limit on how low a price you would sell your business for, you want a hard limit on how much you are going to do for a buyer.

What to do 30 Days Out From Listing Your Business for Sale

With only a month left until you list your business for sale, there are still a few things to do. Most of this can be done within 30 days, though it might be worth doing some of these tasks throughout the life of your business to make sure you have as much information as possible before making some of these final key decisions.

Look for Strategic Buyers

It is good to look at the open market to find people who would really benefit from owning your brand. For example, if you have a dog food content website, it might make sense to create a spreadsheet of ecommerce stores that sell dog-related products, as a shortlist of people to reach out to and let know that your content site is for sale.

Keep in mind before reaching out that you might not want competitors to know your business is for sale because:

- You will have to open your books to your competitors, who might only want to look at what you are doing and reverse engineer it;

- They might try to poach your employees or contractors;

- They may learn all your best-performing keywords for SEO and go after them.

As you can see, there are some real risks here in reaching out to strategic buyers if they’re your direct competition. That is why it is usually better to reach out to buyers whose main businesses are tangentially related, e.g., a marketing SaaS business offered to a marketing services agency.

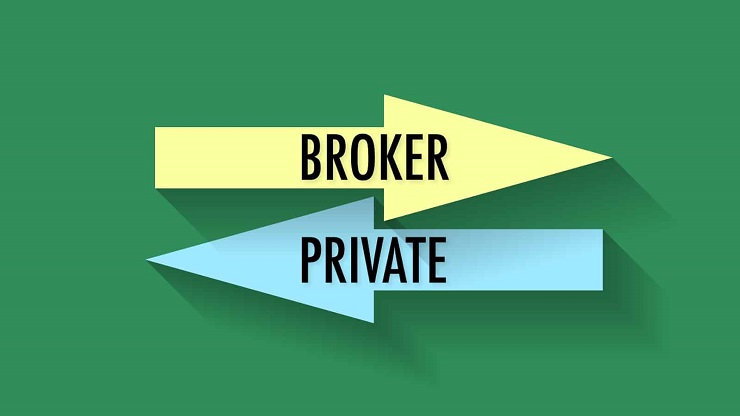

Consider Getting a Broker—Are They Worth It?

Online business brokers are businesses that make their living helping people buy and sell digital assets every day. While that makes them professionals when it comes to helping you sell your business, you will still want to research different brokers and make sure the one you choose is the right fit for you.

It is still a pretty new industry, so there are a lot of fly-by-night style brokers. Ideally, you will want to go with a broker that has a team, systems, and processes in place, and most importantly, a track record of selling businesses that are similar to yours in terms of monetization type, traffic type, and size.

In other words, if you have a business worth around $1 million that gets traffic from Facebook ads monetized via the ecommerce store model, you will want to find a broker who has done these kinds of deals, or something similar, successfully. It’s a good idea to pore over their case studies and reviews and even contact brokers individually to see how they mesh with you.

It is important to remember that brokers make their living through a commission on the sale of the business. This means you could potentially make more money if you take the private route (our fee at Empire Flippers is 15%, for example).

Good, professional brokers, however, can usually command a higher price for your business than you would be able to alone, for a whole set of reasons. This means that even when you subtract the commission, you may still make more money by going through a good broker.

Some of the hurdles you will have to overcome if you sell privately are:

- Buyer Reach: Most business owners do not have a large rolodex or email list full of people looking to purchase online businesses. This can be a real struggle for someone going the private route.

- Qualified Buyers: This goes hand-in-hand with buyer reach. Most people who approach your business will likely give you lowball offers. Professional brokers weed these people out. If you go privately, consider setting up a process that qualifies buyers quickly.

- Negotiations: Most people are unlikely to be very skilled in the negotiation process, since most of us don’t deal with selling digital assets to investors and portfolio buyers every day.

- Migrations: Actually handing over the keys over to the new owner is often not a simple process. A good broker will guide both you and the buyer through the process of transferring the business and do most of the heavy lifting.

At the end of the day, I am obviously biased since I work for a brokerage, but selling your business through a broker can absolutely be worth it for all the hassle, time, and work they can save you. That being said, if you have a large audience in the online business space, it may make more sense for you to take the private route. For most people, that is unlikely to be the case.

If you want more information on what to watch out for when it comes to researching good online business brokers, I wrote an entire post on different things to look into before making a final decision on a broker that you can read here.

Submit Your Business for Vetting

This part is only relevant if you decide to go down the online business broker route. Once you find a broker that resonates with you and you believe can get the job done, it is time to actually submit your business for sale.

During this process, the broker will be going through your business and making sure everything is on the up and up. They will be looking through traffic, financials, what the business has done in the past, where it’s trending now, and how much it is diversified in terms of traffic and streams of revenue, etc.

This whole process, depending on the complexity of your business, can take two to four weeks before the broker actually begins the marketing process. That means the majority of this month will be taken up by the broker vetting the business for you. It is a highly important process, so be patient, as it can help the broker create powerful marketing content to attract the right qualified buyer as soon as possible.

Remember Your Hard Minimum Sale Price!

The bigger the price tag your business is likely to command, the more negotiations will likely need to take place. You need to know what the hard minimum price is that you will consider selling your business for.

In the heat of negotiations, you might be tempted to lower your price. Get serious and set a hard minimum price that you will be willing to accept. If you go the broker route, make sure they know your limit so they will know what kind of offers they should bring to the table.

Anything Else? The Final Pieces Before Selling Your Business

At this point, you are either through the vetting process with the broker of your choice or have begun to privately reach out to strategic buyers. Congratulations, your business is officially for sale!

If you have followed all the advice above, you’re significantly ahead of the vast majority of people trying to sell their digital businesses. That gives you a good advantage, and a much better chance of landing a big payday.

Now that your business is for sale and courting possible buyers, what should you expect? There’s a couple of things you should be prepared to share with potential buyers:

- Google Analytics/Clicky Dashboard: People will want to see what is happening with your traffic. You can usually just use view-only access with these services, and some buyers will accept screenshots.

- Explaining Traffic Sources: You should be able to explain how each traffic source works and help guide the new owner on how to maintain the current traffic campaigns you are doing.

Why Your Failures Make Your Business More Attractive

Most people selling their businesses only talk about how great their business is and what a bright future it has going forward.

In our experience, this is the wrong approach. Take a moment to consider the counterintuitive strategy of talking about all the failures, the things that have gone wrong, and the marketing or operational mistakes you’ve made that have hurt or are hurting the business.

Why would you do this?

Because if you sell a buyer on how great a business is and how it is going to become this HUGE website, then that buyer is likely going to give you a lowball offer, usually stating some kind of earn out scenario where he pays you a bonus once it reaches this huge level of earnings.

If you really want to build up a business’s potential in a buyer’s mind, then you shouldn’t talk about where the business could go. You should talk about where the business messed up or even failed.

Let’s say you have a SaaS business whose main marketing strategy has been Facebook paid marketing. The buyer looks at your Facebook paid advertising strategy and sees glaring holes throughout your entire process that they can fix easily.

Or maybe you’ve told them that you haven’t been successful using SEO to drive traffic to your business, and this buyer just happens to build out SEO traffic-based assets day in and day out.

Now this business will look like a huge opportunity for this buyer, and all you had to do was talk about things you have legitimately failed at or are maybe just not that good at.

Give the buyer information that shows the amount of potential in the business. Your pitch will be more powerful and it is far more likely that the deal will get done.

Now What?

That is it!

If you adhere to all the steps above, you will be far ahead of the game of selling your online business for a big exit. Imagine how awesome it is going to feel when you sell your business for a five-figure, six-figure, or maybe even seven-figure price tag.

Whether you decide to sell your business is an extremely personal decision that will need a lot of thought put into it before you make the final call.

And remember, regardless of whether you do decide to sell or not, if you build your business as if you are going to sell it from the very start, you are going to have a much cleaner, more efficient business.

What are your thoughts? Are you considering selling your business? Not sure if you’re ready? Leave a comment below with any advice or questions you have.