So you’ve read the success stories of founders making millions from their businesses, and now you think you’ve got the next great idea. But the only thing you can’t figure out is just where did these founders get the money to fund their startups? Especially in a post-pandemic world, it can be difficult to even think about pulling together funds to start a new business.

Contrary to popular belief, you don’t have to be rich to start a business. Often, we entrepreneurs get so caught up in the excitement of generating new ideas that we fail to talk about the unglamorous side of things, such as how much it costs to execute those ideas, and where the money comes from.

So let’s talk about it

If you’re ready to start a business but are stuck on the funding component, below, I’ll outline the main options available for financing a new business, including equity financing, debt financing, and bootstrapping, including pros and cons.

Equity Financing

This is probably the finance option that gets the most attention in the startup world (but it’s not the only option out there). Equity financing is when you sell part of your company to investors in exchange for capital. As a result, those investors typically get a say in how you run your business and receive portions of future profits. There are a few different versions of this:

Angel Investment

Angel investors are people who invest their own money, typically early on before a startup has proven itself, such as during a seed round (read this for more info on startup funding rounds). In the U.S., angel investors must meet SEC requirements, such as having a net worth of more than $1 million or earning an annual income of at least $200,000. Angels tend to invest smaller amounts than VCs, averaging around $36,000.

To find an angel investor, ask around your network or try websites like AngelList and Angel Capital Association.

Venture Capital

Also known as VCs, venture capitalists are investors that operate as part of a larger fund that pools together money to invest in small to large businesses. Typically, VCs start participating during Series A funding rounds and opt for more established, high-growth businesses. Famous VCs include Andreessen Horowitz, Sequoia Capital, and Founders Fund.

If you want a real-life example, financial technology company Revolut recently raised a Series D round of funding totaling $500 million from investors, including venture capital firm TCV. Launched in 2015 and with more than 10 million customers, Revolut is well-established and is demonstrating enough growth to attract such large sums from investors.

If you’re seeking VC funding, you’ll need to get introductions to VCs (or cold email them), be able to prove your business’s growth, and perfect your pitch deck.

Equity Crowdfunding

You’re probably familiar with crowdfunding from Kickstarter or Indiegogo, where backers essentially pre-order a product. But equity crowdfunding is a financing option where backers pre-order a product and shares in a company.

To see this in action, let’s look at a case study of UK digital bank Monzo’s successful equity crowdfunding campaign. Though at the start of 2017, Monzo had already raised £30 million in venture capital, they wanted their customers to be able to become investors and have a stake in their business. So they started an equity crowdfunding campaign on Crowdcube, amassing more than £20 million from 36,006 investors.

Debt Financing

Debt financing is borrowing money from a lender whom you will have to pay back with interest. In contrast with equity financing, debt financing does not require you to give up control of your company in return—just money.

As when taking on personal debt, if you choose to take on business debt, the crucial factor is whether you strongly believe you can pay it off. If your business is profitable and you need funds to grow faster, then debt financing is a much more appealing option than if you haven’t even started your business and you have no personal capital to self-fund at the start. If you’re in the latter situation, be wary about taking on a burden that you may never get rid of. Debt requires that you pay back the loan, and it could follow you for years to come.

Bank Loan

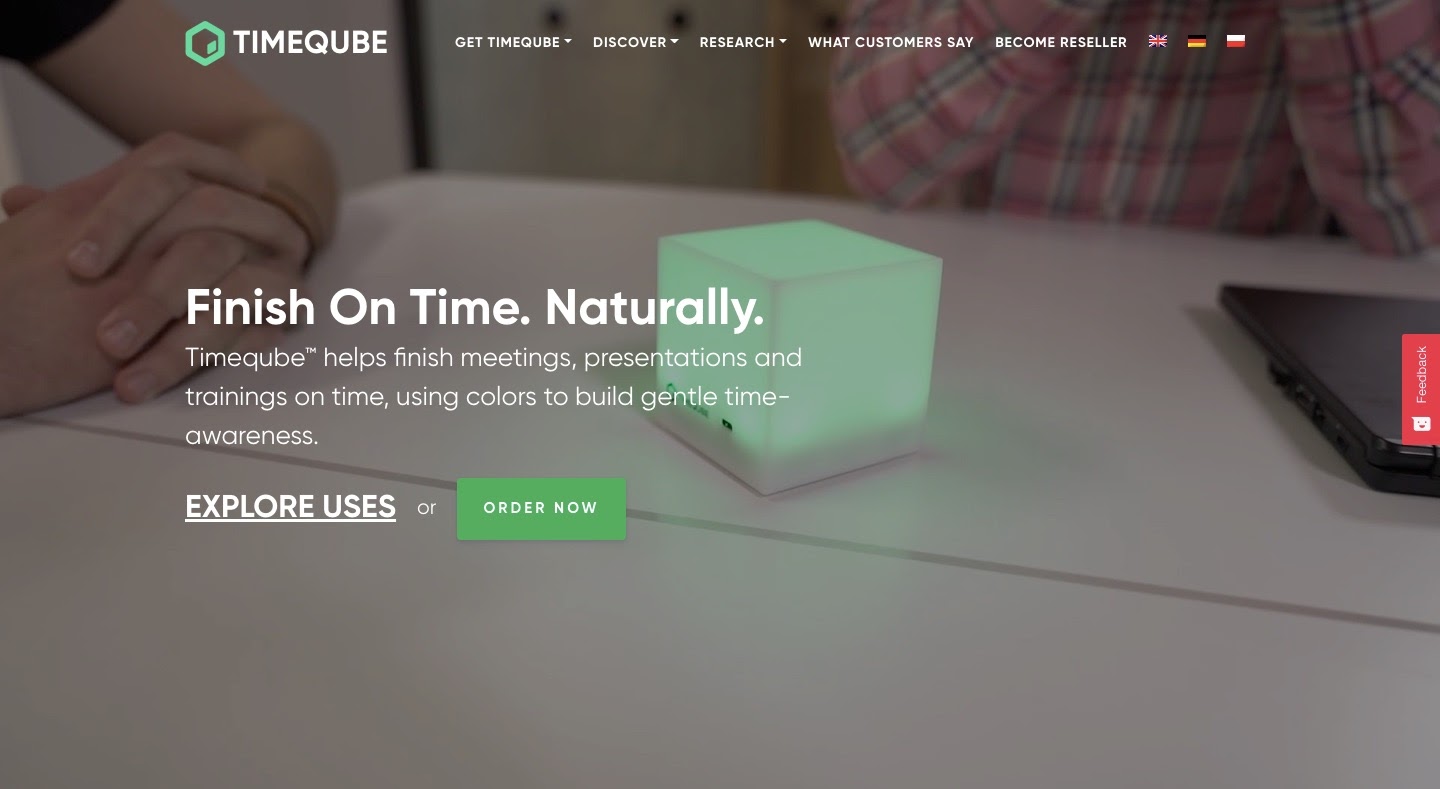

Just like with personal loans, you can go to a bank and ask for a loan to start your business too. That was part of Timeqube co-founder Andrzej Dobrucki’s financing strategy. To cover the manufacturing of the first batch of product, he launched a pre-order campaign, got a $15,000 angel investment, and took out a $15,000 bank loan. Timeqube became profitable after about 12 months of development.

Before you head to the bank, make sure you have a solid business plan to prove that you’ve strategized how your business will earn enough money to pay the loan back with interest. Learn more about the steps to get a bank loan.

Investor Loan

Instead of selling part of your company to an investor, you can borrow money from them and pay them back later. The advantage of this is you retain control of your company. The disadvantage is that, in contrast with angel or VC capital where the investor isn’t guaranteed a return on investment, a loan must always be paid back. This can lead to problems when the loan comes due.

For example, mobile search company Quixey was a rising star after raising about $134 million in venture funding. But when Quixey was unable to pay a $30 million loan from its investor and business partner Alibaba, the business was shuttered.

SBA Microloans

The U.S. Small Business Administration runs a microloan program for small businesses, ranging from $13,000 to $50,000. Just note that you can’t use this loan to pay off existing debt or buy real estate.

Friends and Family

You may have heard of startups that raised a “friends and family round” before seeking angel or VC investments. This is exactly what it sounds like: You ask your friends and family to lend you money to start your business.

That’s what Kim Perell did when the startup she was working for went under and she needed the capital to start over with her own online business. Broke and jobless, she called her grandmother, who loaned her $10,000 to get the idea off the ground. Today, Perell’s company, Amobee, is a global success with about 1,000 employees and 25 offices worldwide. It was acquired for around $30 million. And yes, Perell paid her grandma back.

As casual as borrowing from friends and family may sound, you still need to take precautions and get everything in writing. If the money is a gift (meaning it doesn’t need to be paid back), get a letter to document that the money was indeed a gift. Additionally, beware of the IRS gift tax on amounts above $15,000 in 2020 (this can change from year to year).

Bootstrapping

This term comes from the old saying “to pull yourself up by your bootstraps,” which means to succeed all on your own. Instead of seeking investors or lenders, you fund your own company. Bootstrapping is a favored option for scrappy new business owners who want to retain full control. It does, however, come with its disadvantages, namely, slow growth due to limited funds.

Savings

Dipping into your savings could be a smart way to fund your business, as you won’t owe money to anyone or give up control of your company. Just be sure, however, to keep some savings for your personal needs, such as rent and utility bills.

Spanx founder Sara Blakely started her company with $5,000 from her personal savings. Today, Blakely still owns 100% of her business, which rakes in an estimated $400 million in annual sales.

Credit Cards

If you don’t have cash on hand, you might be able to do what many new founders do and charge business expenses to your credit card. Famously, Airbnb co-founder Brian Chesky launched the vacation rental platform by maxing out his credit cards, racking up $25,000 in debt (his co-founder owed tens of thousands too). Now, Airbnb is estimated to be worth north of $30 billion.

But that’s the exception to the rule. With U.S. credit card debt at an all-time high of about $930 billion, it’s worth thinking twice about whether you should fund your business with plastic. Taking on tens of thousands in credit card debt is risky, especially if your company isn’t profitable yet.

Pre-Orders/Pre-Selling

Another smart way to bootstrap your startup is to take pre-orders. Many entrepreneurs will pre-sell a product to fund the production of the product and the growth of their business. It’s also a smart way to validate your idea; if pre-sales fail, you can always return the money.

Kalo Yankulov validated his idea for Encharge by offering pre-orders before he had even built the product. He created a mock prototype and landing page, and in two weeks, got 50 preorders out of an email list of 500 subscribers. That was enough to persuade him to start building the SaaS product.

Crowdfunding

Crowdfunding through platforms like Kickstarter is another way to pre-sell and get upfront capital to fulfill the pre-orders and grow your business. When Nik Robinson and his wife Jocelyn, co-founders of Good Citizens, needed capital to buy a machine to manufacture their sunglasses locally, they turned to Kickstarter. By focusing heavily on PR, they were able to raise $61,700 AUD through their campaign.

Other

Grants

A grant is money that you don’t have to pay back. These can be prime options for small businesses and nonprofits alike. Federal, state, and local governments often give grants, as well as corporations, foundations, and nonprofits. If you want to get started, here’s a list of 107 grants you can apply for.

Royalty Financing

If you have interested investors but you don’t want to take out a loan from them or sell them a piece of ownership in your business, you could consider a royalty deal. Royalty financing is selling an investor a percentage of your revenues. In contrast with an equity deal, where investors get paid last (or not at all), a royalty deal ensures investors get paid first, right off the top of each sale.

Equity vs. Debt vs. Bootstrapping: Which One Is Right for Your Business?

It’s always best to get advice from people who’ve experienced something firsthand. So I’ve gathered tips from some of the many interviews Foundr has conducted with accomplished entrepreneurs. Check out their opinions on financing options below:

Mark Cuban, Serial Entrepreneur and Shark Tank Investor

Sweat equity is the best equity. You’ve got to do everything possible not to raise capital, ’cause the minute you take someone else’s money, then all of a sudden, instead of just your obligation being to the success of the company, or your customers, or your employees, you add another perspective where, okay how am I going to make the bank, or how am I going to make my investors happy? And if their perspective differs from yours, you may have other problems that you didn’t bargain for. So wherever possible, I always, always, always recommend that you bootstrap.

If the business is that predictable, then you can borrow money, which, if you’re profitable, you can pay it back. And so if you need equipment or you need to enter a new market, again as long as it’s predictable and you’re very confident, then just go to the bank. And with the track record, you should be able to borrow.

Jimmy Kim, Co-Founder and CEO of Sendlane

Bootstrapping is great, and it’s a way of life, of course. I totally respect it, and I think that it’s been a great journey for me for multiple companies. … Being bootstrapped, you’re always going to slow yourself down because of revenue and money, but when you have a large infusion of money, it becomes a different mindset because now all you’re focused on is growth and not the money.

Ankur Nagpal, Founder and CEO of Teachable

I’m always very impressed with bootstrap startups, but I almost feel like funded startups get a really bad rap because of the way funding used to work, right? In the past, you’d be like, “Why would you want to raise funding and give up control?”

If you look at the kind of term sheets available right now, you never actually give up control. The way we raised our funding is we never give up any operational rights to any investor. We don’t have to report to an investor. I send a monthly report because I want to, not because I have to.

So I almost look at it as the best of both worlds. We have capital to make mistakes … We still control our own destiny. We don’t have a board of directors to report to. We don’t have anyone with, you know, any kind of significant operating control. It’s still our business, just better funded.

Janine Allis, Shark Tank Investor, Founder and Director of Boost Juice

I’m a firm believer that you always ask for money when you don’t need it, and the only way you’d know you’d need it is by planning well in advance to see when you actually are going to get yourself into a bit of a pickle.

Money management tends to be probably the worst trait of most entrepreneurs. They get so excited about the idea and the journey that they forget that they have to have those foundations solid for them to be able to live their dreams.

How Will You Finance Your New Business?

As you can see, there’s no shortage of finance options for a new business. While there are passionate opinions on all sides of this issue, there is no right or wrong way to fund a startup. It all comes down to your particular wants and needs.

If you’re willing to relinquish some control over your business and get a significant cash influx, it may be time to start looking for investors. But if you’re willing to stomach slow growth in favor of full control, then bootstrapping might be best for you.

Whatever you do, just know that a lack of funding shouldn’t hold you back from starting a business. Even in a post-pandemic world, you can start something and go at it slow until you’re ready to put more money into it.

Good luck, and as always if you have any questions, please let us know in the comments!