What do Airbnb, Slack, Uber and their founders have in common? They’re all examples of what life can be like when you make it big as a tech startup founder. But billions aren’t made overnight. It takes a great idea, an even greater team, and usually some money to get started. Where should the money come from?

Tech businesses are dominating the economy. But they’re also expensive. Unless you’re a coding whizz with hundreds of spare hours up your sleeve, it’s unlikely that you’ll be able to build one all on your own.

Fortunately, if you’ve got a great idea, there’s never been a better time to try and turn it into a high-growth technology company. With all the options out there, when you’re considering funding, which is the best route for you?

The reality is that when you’re finding funding for your tech startup, different approaches have major advantages and disadvantages.

We spoke to founders who’d funded their businesses themselves, crowdfunded them, or successfully landed private investors or venture capital funds (VCs), and got their insights into how to secure funds—and the significant pros and cons that you need to consider before pursuing each option.

FREE MASTERCLASS: How To Start a Tech Startup And Get Your First Customer In 60 Days

1. Angel Investors

When it comes to getting funding for your tech startup, private investors aren’t called angels for nothing. In the US alone, they control over $65 trillion in wealth and as a result, have the ability to turn your idea into a billion-dollar business simply by signing on the dotted line.

Most of the world’s most famous tech startups all received angel funding at some point, and, hey, look at where they are now. Private investors are also a plentiful option, as they invest in 16 times as many companies as VCs do.

But does all of this cash come at a cost?

We spoke to Rob Brown, founder of global parking app KERB, to find out. He was sitting in rush hour traffic one day on a crowded Sydney street when he had an epiphany: there are so many empty driveways, and not nearly enough parking spaces in and around the city. Shouldn’t someone do something about this?

Rob thought he was onto something, but as a marketing executive, he also knew that if he was to solve a problem like parking, he’d need to invest in tech. At the time, Rob worked for a large listed company and many of his colleagues were technical experts. He decided to approach one of them, Matt Salmon, who was an experienced app developer. Matt loved Rob’s idea and from there, KERB was born.

Initially, they self-funded the development of their tech, which they worked on over a period of nine months in 2016. Due to the fact that Matt was already an app developer, the pair made considerable savings on the development, a fact that Rob would later consider integral to their success.

“If it wasn’t for Matt, developing KERB would have cost half a million dollars, if not more. If you’re building a tech business, a tech cofounder is essential,” he says.

KERB launched in October 2016 and all signs pointed to the fact that it would be a success. Yet approximately 18 months in, Rob and Matt realized they needed a much bigger team to support ongoing growth. So they turned to private investors to help them grow.

“We started off by looking at a few VCs, but most of them said to us, look, your business is just too early stage. It was then we started looking at private investors.”

Given that KERBwas an international business from the beginning, Rob approached investors in countries all over the world, knowing that they’d be able to bring not just funds, but vital local knowledge to the business. As with all forms of investment, Rob wasn’t always successful:

“I’d often get on an international flight to present to an investor, to then find that for one reason or another, they weren’t interested. When you’re looking for investment, you have to be conscious of that. Out of every 10 people you meet, maybe one will invest. But of course, you get on that plane anyway.”

From his network, Rob was able to secure an initial investor, and then a few more through word of mouth, then a few more after that. After he finished his raise, Rob had secured $3 million from 27 different investors.

Based on his experience getting funding from private investors, here are the pros and cons:

Angel Investment Pros

1. Experience: Many angels are high net worth individuals who have made their money in business. As such, Rob says they can provide a wealth of knowledge and experience.

2. Networks: According to Rob, some of his most valuable connections and introductions have come through his investors. The networking value of angels can make them at least as valuable as the funds they provide.

3. Flexibility: Rob says that if your angels feel confident in the direction of your business, they may be open to investing more. This will save you from looking for more investment later.

Angel Investment Cons

1. Time required: Rob says that looking for angels can be no less than a full-time job. This can be a disadvantage because as a founder, it takes your focus away from the business.

2. Desire for personal involvement: Some angels may have put their life savings into your business and as such, want to be involved in its day-to-day operation. “Some of our investors wanted to meet every week for a coffee, they wanted a full financial and operational update. But how could I do that? If I met with all 27 of my investors, I’d get nothing done. I negotiated the terms of their updates at the start to avoid an awkward situation.”

3. Time required to produce reports: Despite the fact that Rob negotiated the terms of his angel updates, the time required to produce reports is high, he says.

2. Venture Capital (VC)

If private investors are the angels of funding, VCs are also heavenly creatures. Last year alone, a staggering $254 billion was invested in startups globally, with over 18,000 startups funded. This was a quantum 46% leap from 2017’s numbers.

But what’s the actual difference between VCs and angels? We’re glad you asked, because it isn’t always clear. Typically though, VCs are funds where multiple wealthy individuals contribute a specific amount. The fund managers then decide where to invest on behalf of the individuals. Individuals may choose to invest via VC funds for a number of reasons—they may want more certainty or their contribution may not be big enough on its own. Angels may invest through VC funds, but they may also invest directly.

One founder who understands how to get funding for a startup within the VC landscape like no other is Chad Stephens, cofounder of Fillr, an autofill app. He’s now been involved with multiple VC-led raises, and told us what he considers to be the pros and cons of this type of investment.

Fresh from the sale of their previous tech company, 1Form, Chad and his cofounder knew they weren’t finished.

“1Form was an online tenancy application form, and it was a huge success as no-one wanted to fill out the same form hundreds of times. We then started thinking—what other forms do people fill out hundreds of times and hate?”

Chad and his team eventually pivoted from the idea of a form to the concept of autofill. If they could create a world-class autofill, they figured, then they’d be able to tackle not just one form, but every form.

The team got to work developing intelligent autofill, but there was just one problem—it wasn’t cheap. Even though Chad had overseen the development of a web form before, he was surprised at how expensive app development was.

“Honestly, to this day, we’re still shocked at how much app development costs,” he says. “To date, we’ve spent nearly AUD $18 million developing what is now Fillr.”

Chad and his cofounder had initially used money from the sale of their previous tech company to fund Fillr, but after about 12 months they realized they’d soon run out of money, and would need to raise. This started what Chad describes as a long and time-consuming process, first the Seed round and then the Series A round.

“We developed a lengthy pitch deck and we started presenting locally, getting feedback. But in Australia, honestly, we got a lot of nos. The investment community here are quite conservative and wanted to see revenues. We were a fair way off making money at that stage so they said we weren’t for them.”

Chad and his team had more success in the US, but it didn’t come without considerable effort.

“We were cold-calling, emailing, every day. My cofounder Chris kept a tally, and we got 120 nos. That’s a lot of rejection and you do start to worry.”

In Silicon Valley, however, VCs were less concerned with how much a company was making than its potential for growth.

“I would caution other founders that this has changed, though. Given all of the recent scandals, VCs now expect you to present a detailed plan with a clear path to profitability.”

Despite the rejection and frustration, over a period of six months, Chad and the Fillr team did raise an incredible AUD $5 million.

Based on his experience, getting funding from VCs has the following pros and cons:

Venture Capital Pros

1. Credibility: Fillr raised funds from Softbank China, one of the best-known VC funds in the world. Chad says that this has given his company significant credibility and opened up new doors.

2. Expertise: One of the representatives from Softbank China now sits on Fillr’s board, and Chad says that his expertise is invaluable. Getting VCs onboard is more than just money—it’s help when you need it.

3. Connections: As a tech company, your tech is never “done,” Chad cautions. As such, subsequent raises will always be on the horizon, and VCs provide you with valuable connections and the option to raise more if required.

Venture Capital Cons

1. The maybes: One significant frustration for Chad and his team were the maybes—VCs who seemed interested, but wanted to wait until others invested first, or weren’t sure for a myriad of reasons. Chad felt that he spent a disproportionate amount of time chasing these funds, a significant con of this type of funding.

2. Time and disappointment: Like Rob, Chad warns founders that fundraising can be very time consuming, so much so that, “for the best part of six months, it was almost a full-time job. Clearly this is taxing for a small business, to have a founder occupied for that long.”

3. Time required to produce reports: Chad also mentioned reporting as a disadvantage of having VC investors. And for his team, the reporting requirements do take a lot of time—they estimate that they spend a couple of days a month producing reports, and that it’s taken a lot of time to get the reports “just right” for what different VCs want.

FREE MASTERCLASS: How To Start a Tech Startup And Get Your First Customer In 60 Days

3. Crowdfunding

As founders, we all know it’s critically important to test our business ideas before we officially launch. And what better way to do that than to see if someone will actually buy what you’ve created? One form of funding that’s perfectly suited to testing this is crowdfunding. You’re able to pre-sell your product to tens of thousands of people, proving once and for all whether the tech you’ve developed is a hit, or not.

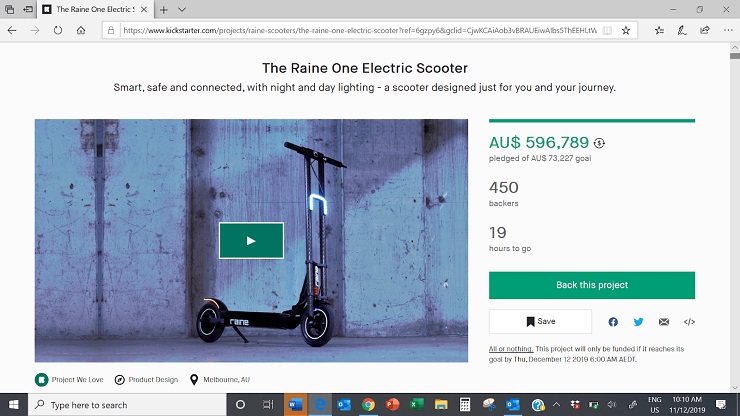

But how do you do it? And is it worth it? Michelle Mannering, cofounder of Enova Design, certainly has some strong views on that. Enova is currently running a Kickstarter campaign for their Raine One electric scooter, which has raised funds far in excess of its $73,596 goal.

Michelle, who had run numerous businesses before (including an AI company), first met her co-founders in 2016 while participating in the Melbourne Accelerator Program, an Australian-based startup incubator. She hit it off with James Murphy, one of the founders of the program, and soon was involved in his company, a skateboard business.

Although the skateboard business was a success, Michelle and James had long been noticing how popular electric scooters were becoming, and decided to turn their many talents to creating something unique in this space.Her co-founder James, in 2018, had started to design what would become Raine One. They met Marc Alexander, and the trio then decided to develop the product.

“It sounds glamorous and fun, but sometimes it wasn’t. We were building it out of a garage, we sourced parts from anywhere and everywhere. There was lots of hack jobs, lots of late nights,” Michelle says.

The team eventually finished the Raine One, but Michelle knew that was only the beginning of their journey.

“Building it was one thing, but creating it for the masses was going to be entirely another. It was immediately clear to us that crowdfunding would be a good source of funds for that, as it would ‘prove’ the concept, but more importantly, give us exactly what we needed—customers.”

Michelle also knew that the marketing required to run a successful Kickstarter campaign was no small undertaking. Although she knew a bit about marketing, she wanted to hire true experts to run all aspects of the campaign, so the Raine One team led a small VC round.

“To make Raine One a success, we wanted experts in everything. We wanted AdWords experts. We wanted professional videographers. We wanted it all, so we completed a raise so we could have the funds required to get it all done professionally.”

Michelle and her team were able to raise VC funds, which they then used to cover the cost of the Kickstarter campaign. “To cover marketing, honestly, to get real experts, you do need nearly a six-figure sum.”

Michelle and the team’s investment in their Kickstarter campaign has certainly garnered a return. To date, the Raine One has 450 backers, and has raised more than $596,789.

Based on Michelle’s experience, here are some crowdfunding pros and cons:

Crowdfunding Pros

1. Customers, pre-launch: Michelle says the single biggest advantage to using crowdfunding is the customers you gain, pre-launch. Having this derisks later stages of your business, as you already know you have a captive audience.

2. Marketing: Another significant advantage of using popular crowdfunding platforms like Kickstarter is the marketing you gain access to: “Kickstarter’s hugely popular, they’ve got an audience in the millions. Having access to that type of database is invaluable.”

3. Nothing complex required: Unlike, for example, pitching for VC funding where you might have to put together complex documents, Michelle says that Kickstarter is easy to use, especially if you have product-based technology.

Crowdfunding Cons

1. Crowdfunding platform fees: Michelle doesn’t necessarily consider this a con, but she does think it’s important that other founders are aware that if your project is successfully funded on Kickstarter, they do take an 8-10% fee.

2. Marketing costs: Although Kickstarter campaigns may seem easy, in reality, a lot goes into successful campaigns. Michelle advises that you either need to have the skills yourself, or pay a professional to produce great videos, copy, and to run your social media advertising.

3. Scams: Although Michelle didn’t personally experience this, she says that founders do need to beware of potential scams on Kickstarter, in particular, companies offering to ensure your project is funded by millions of people.

Recommended article: How Foundr Generated $200,589 of Pre-Sales for our Coffee Table Book Using Kickstarter

4. Self-Funding

Of all the options available to your tech startup, you might think that funding it yourself seems the least appealing. Where can I get with a few thousand dollars, you might ask?

The answer is, quite far.

Sometimes called “efficient entrepreneurship,” there are more companies than you’d think that have started from the few thousand dollars the founders had saved (or less).

Think it’s not possible to start a company with less than $100? Mailchimp, Lynda, and Shopify all started with scant funds, and that’s certainly worked out for them. You might call self-funding the new angel investing.

But when tech costs so much to develop, how does self-funding work? Sandy Hutchison, who funded her HR tech startup Career Money Life herself, told us what startup life has been like when you’ve only got your own money to spend.

Back in 2014, Sandy was in an executive HR position when she experienced a challenge many of us can relate to: she was laid off. But Sandy ended up having a positive experience.

“For a long time, I’d been thinking of starting my own business. My employer was allocating funds to help me with my job search, but instead, I asked if they could be used to help me create a business. To my surprise, they said yes.”

Sandy had already had the idea for Career Money Life, and the positive experience she had after her unemployment spurred her on to pursue it.

“I was able to personalize my experience. But mostly, employees aren’t offered this. So I wanted to build a digital platform that enabled employees at all companies to enjoy individual benefits.”

Using her connections, Sandy was able to assemble a team of local developers to start building her platform. She used both her own savings and money from her unemployment to do this. Ultimately, having limited funds helped her to become more disciplined in her development process:

“My co-founder led the tech side of the business for me, he was able to give detailed briefs to our developers. We didn’t always get it right, of course, but having a detailed scope and a disciplined development process helped us iterate quickly. When you’re self-funding, you can’t afford to go too wrong.”

As Sandy and her team began to take on clients, their stance on self-funding didn’t change. In fact, it took away a lot of pressure.

“As it was all of our own funds, we had complete control over the business. This meant no unrealistic expectations, no focus on short-term profits and wins that might encourage us to overlook our longer-term plan.”

As Sandy gained clients, she was able to use profits that she made to reinvest in further tech development. This was hugely beneficial.

“As opposed to many tech startups that build it and hope, we were able to build our platform out with our clients, and so build in features they wanted. It made us perfectly customer-centric.”

And Sandy’s strategy of building for the clients has certainly paid off. Career Money Life recently celebrated its fifth birthday and has grown an incredible 40% this year.

Based on Sandy’s experience, funding your tech startup yourself has the following pros and cons:

Self-Funding Pros

1. Control: Sandy says that the best part of self-funding her tech startup is that she is 100% in control of the business, can make decisions without scrutiny, grow at her own pace, and not worry about producing short-term returns.

2. Time and effort saved: Searching for funding often means that you’re taken away from the business. Because she’s never had to do that, she’s been able to focus purely on business growth.

3. Discipline: Spending your own funds means you’re highly disciplined. Self-funding has forced her to be more creative and innovative in how she does things, and that can only be a good thing.

Self-Funding Cons

1. Less cash: This one is obvious, Sandy says, but if you’re self-funding you’ll very likely have less money to spend than you otherwise would!

2. Speed to market and ability to scale: Fewer funds has another downside, and that’s your ability to scale. “We haven’t grown half as fast as we might have if we had funds. But we’ve also taken that time to learn and iterate, so I’m not sure it’s that bad to have done it this way.”

3. Missing advice: VCs and angels can be a great source of advice, Sandy says, and that’s something you don’t get when you self-fund. To compensate for this, though, she recommends assembling a board to provide oversight.

FREE MASTERCLASS: How To Start a Tech Startup And Get Your First Customer In 60 Days

Money Isn’t Everything

As famed investment firm Nuclear Partners once stated, “Startup financing is not just about raising funds. It’s a holistic process that involves proper business planning.”

When you’re getting funding for your tech startup (or if you choose to self-fund), you’ll need to think about your business and your plans for it in the future.

Do you want more control? Do you want customers prior to production? Can you spend a few days a month producing investment reports? All of these questions will help you decide what sort of investment would suit you best.

Have you had good or bad experiences seeking funding? What happened? Tell us everything below.