Here’s a little Foundr behind-the-scenes secret—I’m lousy with numbers.

I know I run a business that advises on entrepreneurship. And don’t get me wrong, I do pretty well when it comes to tech, marketing, planning, strategy lots of the skills you need when it comes to running a fast-growth startup like ours. But when it comes to ledgers, balance sheets, budgets, all that fun stuff, it just doesn’t come to me naturally.

But I’m here to tell you, if you’re like me and you hate managing the nitty-gritty dollars and cents, it’s OK. There are enough great tools and advisors out there that you can double down on your own strengths and still be quite successful.

But, and this is big, that does not mean that you can simply ignore your company’s cash flow.

Even if you’re not a big numbers person, all entrepreneurs must train themselves to stay on top of cash flow—what’s coming in, what’s going out, and how much you have access to. If you don’t work out your own functioning system for staying on top of these key numbers, you and your startup can get into big trouble, fast.

Knowing this is such a rough spot for so many early stage entrepreneurs, I thought it would be helpful to lay out why staying on top of your cash flow is so important, and how we handle things here at Foundr especially as a bootstrapped startup.

This article won’t have you walking away a certified accountant by any means, and we’re not going to get into the down and dirty accounting principles. It’s more of an overview of why this is so important to you and your business, and some of the basics of how one company approaches it.

Managing Business Cash Flow—Why is it Important?

I’ll never forget one particular moment during Foundr’s journey. It was actually one of the best periods of growth we’ve ever had, a couple of years back. Our revenue had exploded, numbers were on the way up, and I was feeling great. Then one day my accountant tells me, “Oh hey, you’ve got this tax bill that needs to be paid.”

It was … a big tax bill.

We’re talking the kind of money I used to make in a whole year at my day job + more, and I did not have that kind of cash sitting around. Where was I going to get it? Why did I not see this coming? It seemed like things were going so well!

Turns out, when you’re not making much profit, you don’t have to pay much in taxes. But now, even as my business was going gangbusters, I was suddenly in a terrible position when it came to our cash flow.

Suddenly it became an extremely stressful and frustrating time. I ended up being able to pull the money together to cover it, but If I had planned properly and I knew how to manage my cash better in those early days, I could have avoided putting myself, and our business under that kind of stress.

This is a very basic business concept that a lot of entrepreneurs don’t really take into account early on, myself included. I used to think that when you run a business, you generate sales, and you spend money to generate those sales. But what happens in between? What if you’ve just spent 10 grand on a bunch of physical stock that you know can bring revenue in sales, but you’ve spent all your cash on the materials and can’t pay for shipping? Who’s going to pay to ship it?

All this is to say, when you have a growing business, or you’re just starting out, you always have to have the right amount of cash flow in the bank. And the sooner you teach yourself how to manage your cash flow, the better.

The Lifeblood of Your Business

Aside from avoiding the stress of noob situations like the one above, managing cash flow is important for another reason—if you don’t have enough, your business can’t thrive and grow. At the end of the day, your business lives and dies by its cash flow. That means having money coming in, and cash in the bank that you can depend on in order to survive.

On one end of the spectrum, you need to make sure you have enough cash in the bank to keep the business alive, and that’s a scary thought. That one day, you could just zero out your bank account, and it’s game over.

This danger comes into play, even when you’re just sustaining the daily operations of your business, based on routine fluctuations in your revenue. Say, for example, you’ve got to buy more raw materials in preparation for the holidays, but you still haven’t sold all of your previous stock. Or in the case of a digital business, say you are working on a labor-intensive product that’s not ready to be sold yet, but you still have to pay wages. Where does that money come from to help the business stay afloat? This is referred to as a “cash crisis.”

On the other end of the spectrum, cash flow is all about being able to grow. If you don’t have the luxury of raising capital (someone else’s cash flow), this can get tough very fast when your company is expanding. You start to play with bigger dollar amounts, more transactions are happening, and you suddenly have more to worry about more expenses. Your expenses rise with your revenue, not just things like taxes, but transaction fees, staffing, new SaaS subscriptions, customer service, etc.

As more revenue comes in, you’ve also got to allocate a portion of that to reinvesting in the business so you don’t stagnate. Hiring new staff is a classic example. To take things to the next level, you need to bring on more people to handle the workload and even expand what you offer your users. But knowing just how much money you can afford to sink into the business, to hire a new customer service team member, for example, can be really difficult when you’ve got money constantly coming in and going out.

Developing a good system for cash flow management can give you the peace of mind, and foundational knowledge of what you have to work with. This will not only keep you from draining your reserves, but can also allow you to power up to the next big step.

What Is Cash Flow?

In a nutshell, cash flow is defined as the amount of cash and cash equivalents (assets that can be readily turned into cash) that are moving in and out of a business. A lot of business owners make the mistake of thinking this is the same as revenues minus expenses. Getting this right is about more than just seeing if you’re turning a profit on your financial statements.

You could, in fact, have a business that turns over millions, but has no cash in hand. And this actually happens, because there are things like accounts receivable, accounts payable, inventory, capital expenses, debt, and other timing factors that result in poor cash flow. Then something unexpected comes up, as they always do, and you’ve got a cash crisis on hand.

Here are some of the concepts that define your cash flow:

Revenue/Sales: When you provide value to your users, that can translate into receiving money in return, which is the point of any business. The more value you provide, the more revenue you receive. But that revenue doesn’t typically come in an even, unfettered stream. Nor is it in direct relation to your expenses.

Expenses: This is what it costs your business to provide that value that converts to revenue. Expenses include both fluctuating costs that rise and fall depending on how much business you’re doing, and your overheads.

Overheads: These are the fixed costs of doing business that are not directly related to the manufacture of a product or delivery of a service. Whether you’re going gangbusters or in a dry spell, these don’t go away and must always be paid. You always need enough money in the bank to cover overheads, otherwise you’ll have to incur debt (or investment). This could include rent, vehicles, or any other operational costs.

Profit: The money a business has once all expenses and taxes needed to sustain its activity are paid in full. Profits can either go right into the owners’ pockets, pay down debt, or be reinvested back into the business to create growth. Profit is not the same as cash.

Liquid Assets: This is the combination of cash on hand and assets that you can convert to cash readily without losing market value. A classic example of an asset that is not liquid, for an individual or family, would be the value of a home. It could be sold very quickly, but likely for much lower than market value. Your cash flow will determine the size of your liquid assets, an important marker of a company’s strength.

Inventory: How much of a product you have on hand to sell. Inventory’s worth something, but it’s not considered liquid assets. It’s only worth something if you can sell it at market rate. You could have low cash flow because all of your assets are tied up in inventory in a given period.

Accounts Receivable: This is when bills are due to you, but they haven’t been paid yet. So on paper that money belongs to you, but you don’t have it in hand so that can hurt your actual cash flow. You can’t readily turn these sums into cash.

Accounts Payable: This is basically debt. Money you have to pay to others. This can complicate your cash flow, because you have cash on hand, but still owe a bunch of money to vendors, etc.

Positive Cash Flow: This should be your status quo, in which the money coming in during a specific period is greater than the money going out in that same period. Again, this is not identical to profit, and happens as a result of careful planning and timing of expenses relative to revenues. Positive cash flow is also not always a good thing, as too much means you may not be producing enough product or enough capacity to deliver a service, and therefore may be losing sales and potential revenue. But steady positive cash flow means your liquid assets are increasing, which means a company can settle debt, reinvest for growth, cover all expenses, and have a safety net in case things go awry.

Negative Cash Flow: Negative cash flow, as you may have gathered, is when in any given period the money coming in is less than money going out for that same period. This means your company’s liquid assets are decreasing. This isn’t the same as negative net income or losses to the company, rather it’s a result of mismatch between income and expenses. Chronic negative cash flow, however, usually points to running at a loss, leakage of funds (theft or fraud), or poor management of credit.

Again, profit and cash flow are not the same. For example, you might have a very profitable business, but maybe you’re spending constantly to fuel the business and that’s outweighing any profit.

You might have a great software on the market that generates a profit, but the development costs of keeping the asset improving could outweigh what it’s bringing in. Or in the case of a physical product, you may have a batch of 5,000 units that are selling really well and turning a strong profit. But the batch is about to run out and you need to produce or buy more, and you’ve spent all your cash on other things to keep the business moving (hiring staff, developing new products, marketing). While in the long run, you may be profitable (i.e., total revenues exceed total expenses), suddenly you’re in a negative cash flow position and may not be able to turn your assets on hand into revenue.

How Foundr Manages Cash Flow

At Foundr, we’ve embraced two key principles that have really changed the game when it comes to improving our cash flow. I wish I would have known about both of these concepts much sooner, as it would have helped us to grow much faster, and saved me a lot of stress in the process.

The first is aiming to improve our cash flow reserves, and the second is using a “Profit First” system.

The Importance of Building Cash Reserves

If I could give one piece of advice to aspiring and growing startup founders it would be this: build up your cash reserves. My mentor impressed upon me that a company should always have at least three to six months worth of operating expenses in cash reserves.

Your cash reserves are simply a pool of money that you keep on hand to meet short-term or emergency needs as they arise. They can be in a simple banking account, or in some kind of short-term investment assets so you can turn them into cash fast. The point here is that, if you run into a problem—legal expenses, a need to pivot, heck, even a fire—you are not going to be driven into the ground. But strong cash reserves also allow you to seize upon opportunities, growth strategies, and investments.

At the largest scale, companies like Apple or Alphabet tend to have cash reserves in the tens of billions of dollars. This kind of reserve allows Alphabet to make purchases like when it acquired Nest for $3 billion in 2014.

Now, you’re obviously not going to have or need to have that kind of money on reserve, at least not likely any time soon, but the three to six month range is a great goal. Full transparency, we’re not there yet at Foundr, but at least the equivalent of a couple of months in expenses is a great way to give you the kind of flexibility necessary to maintain positive cash flow.

Recurring Revenue

Here at Foundr, we have also started focusing on building recurring revenue streams to help increase our cash reserves. Recurring revenue supplies the business with a somewhat predictable monthly flow of revenue, which helps ease the cash flow pressures (and makes us sleep a bit easier!).

We like the recurring revenue model, because it provides us with some stability, and buffers the uncertain income fluctuations common with growing businesses. Building this ongoing revenue stream mitigates some of our business risk and makes it much easier to manage cash flow reserves, since there is always a steady flow of cash coming into the business.

The Profit First System

Another big breakthrough for us was when I came across a system called Profit First, which is designed by Mike Michalowicz. I’ve discovered that the best way to ease the difficulty of managing your cash flow is to find a good system to stick with. At Foundr, we’ve really embraced this Profit First system.

At the core of the system is something called “Parkinson’s Law,” a principle that dates back to 1955 that says demand for something tends to expand to meet the supply. This law gets thrown around a lot in productivity circles, in the sense that people take as much time to do a task as they have at their disposal.

But in terms of budgeting, Parkinson’s Law means that when you have money within your grasp, you will spend it. And you won’t be particularly careful about it either. Have less of it, spend less. You become more thrifty, but also innovative when you don’t have money sitting around.

Because of this principle, entrepreneurs tend to find ways to use the cash within grasp, because we’re all too often obsessed with maximizing sales and growth. It’s how we measure our success. Get as much revenue as you can, spend the money on expenses and growth, and then if there are some scraps left over, sure whatever, that’s profit. That can get us into trouble, and turn our businesses into “cash-eating monsters,” according to Michalowicz.

Profit First does exactly that, it puts profits first, earmarking a certain amount of your sales to be profit, thereby determining what your expenses are. He encourages you to think of it like this:

Sales – Profit = Expenses

We’re still super aggressive when it comes to our growth, but we do allocate profit to the business intentionally, and it’s allowed us to build up quite a solid cash reserve.

The system’s a little more complicated than that however, and I definitely recommend checking out the book to get all the details. But it boils down to an envelope system, which means as soon as cash comes in, it’s pre-allocated. It already has a purpose, so we break up incoming revenue and divide it into certain places that we’ve predetermined.

Roughly, in our case, we allocate:

10% to profit

10% to owner’s pay

15% to tax

65% to operating expenses

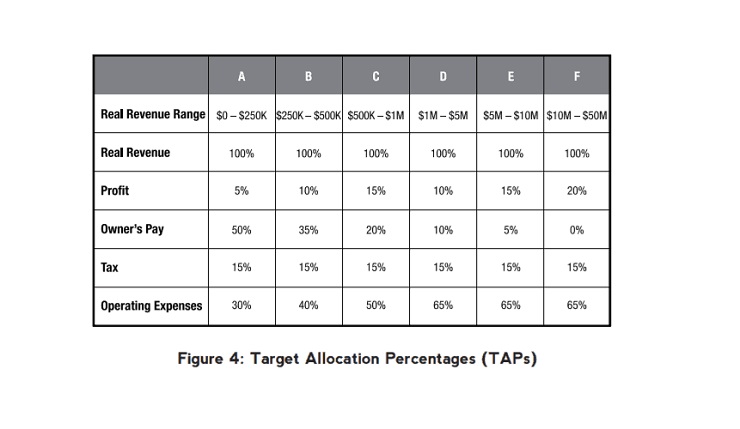

Here’s a breakdown Michalowicz offers for businesses at various stages of development:

This makes us very strict in terms of where our money goes. If we can’t afford it, we don’t spend it. Or if we want to invest in growth, it really pushes us to get creative and push to generate more revenue.

This has been incredibly effective, because, like a lot of entrepreneurs, I didn’t have a problem with how much money we were making. I had a problem with how much money we were spending.

Too often, entrepreneurs go on and on about revenue and sales, like an obsession. It’s how everyone judges your business. And revenue is key, but at the end of the day, especially for small and bootstrapped business owners, I believe we need to be paying more attention to profits and cash flow to ensure sustainability.

Get an Accountant, or at Least Accounting Software

I know, I know, for a post about how to manage cash flow, telling you to hire someone to do it for you is kind of a cop out. But it’s good advice, nonetheless. You might not be at a point where you don’t need to yet, but once you start to make some decent sales, this becomes critical.

Every single month, I meet with our accountant, and he produces a profits and losses (P&L) report. We make sure everything’s on track for allocation of tax, wages, expenses, and that’s hugely helpful in terms of keeping me on top of our cash flow. If you’re like me, not great with the numbers, investing in professional support is simply a must. It’s not an indulgence, as this will allow you to spend your time in areas where you are skilled and can best serve your business.

I also highly recommend the accounting software Xero, which is a phenomenal tool for small businesses. It’s useful whether you’re using an accountant or just on your own. Another service that can be very helpful when your budget is tight is Clarity, which provides startup advice by phone from experts on a pay-as-you-go basis.

Time to Start Thinking About Cash Flow

If there’s one thing I hope you’ll take away from this post, even if you don’t follow the systems or use the tools I recommend, it’s simply that this is an important subject. Managing your cash flow is something that’s not really talked about. It’s not that sexy, especially when compared to marketing or revenues. But even if you’re killing it everywhere else, if you’re not on top of your cash flow, you’re eventually going to hit a crisis, and it could even sink your business.

I wish I knew this kind of stuff I’m sharing with you now years ago. It would have made Foundr grow much faster. But also, it would have saved me a ridiculous amount of stress.

What about you? Do you have similar anxieties over handling your cash? Got a crisis of your own? Hit me up with questions in the comments and I’ll help out however I can!